3 ECS Key Application Areas

3.3

Digital Industry

To be able to manage everything in a machine, factory or company network, industries have divided the necessary technologies into levels or technology stacks. In these levels or stacks, sensors and actuators are closest to processing materials or handling items, and therefore seen as the lowest in the hierarchy in the Edge-to-Cloud Continuum. Moving up the levels, you find super-sets and/or System of Systems and/or interconnected IoTs like devices, unit processes, production or manufacturing lines, operations control, company or enterprise business processes, and an increasing number of machines, lines, company boarders, as manufacturing has become more networked, complex, dynamic and global.

The Industry 4.0 changes to the mode of operation have a profound impact on how are managed and operated the factories, supply chains, construction zones and processes. Powerful networked digital tools are needed to achieve the necessary Situational Awareness and control of autonomous vehicles, robots and processes at various autonomy levels. The technological tools that are part of the Web 5.0 concept can encompass such complex non-hierarchical environments.

The European Industry 4.0 movement needs an open-source-based, stable and extensible semantic Internet to overcome user interface, networking and communication challenges. The Internet with smart agents is an overarching concept containing multiple technologies, such as Industrial Internet of Things, Artificial Intelligence (AI), Advanced Data Analytics, Augmented and Virtual Reality (AR /VR). The Internet with Industrial Metaverse (Digital Twins) can be seen as an expanding set of interconnected virtual and augmented worlds, accessible from AR/VR head mounted displays, desktop computers and even mobile phones. The entities that are present in the Industrial Metaverse may be humans, devices and autonomous physical and virtual machines such as Digital Twins and AI agents.

This SRIA addresses the digitalisation of the major European industrial sectors promoting the European sovereignty in the internal manufacturing ecosystem together with future sustainability and greener industrial processes and artefacts. These include discrete manufacturing (e.g. manufacturing of automobiles, trains, airplanes, satellites, white goods, furniture, toys and smartphones), process industries (e.g. chemical, petrochemical, food, pharmaceuticals, pulp and paper, and steel), provisioning, production services, connected machines, UAVs and robots. Emphasis is also given to any type of factories, productive plants and operating sites, value chains, supply chains and lifecycles, new materials for structures and electronic components.

Digitalisation is as a key enabler for the future success of European industry. This Chapter will address the potential for the development of topics such as responsive, smart and sustainable production, Artificial Intelligence (AI) in digital industry, industrial services, digital twins and autonomous systems. As discussed at the end of the Chapter, nearly all of the topics in the Technology chapters of the SRIA are of vital importance to industrial applications. These include standardisation, engineering tools, cybersecurity and digital platforms. To digitise European industry, potentially all enabling technologies will need to be employed to realise the required competitive edge, and of course a focus on digital industry would not be complete without the enabling technologies.

Today, the digital landscape remains fractured, with significant challenges in areas such as standardisation, interoperability, and translating research to real commercial impact. These challenges must be met effectively if we are to achieve a strong, greener, resilient, responsive European economy, where sustainable, human-centric solutions help Europe achieve strategic autonomy into the future.

As stated in the new industrial strategy for Europe (“Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions: A New Industrial Strategy for Europe”, Brussels):

Europe needs an industry that becomes greener and more digital while remaining competitive on the global stage. The twin ecological and digital transitions will affect every part of our economy, society and industry. They will require new technologies, with investment and innovation to match. They will create new products, services, markets and business models. They will shape new types of jobs that do not yet exist which need skills that we do not yet have. And they will entail a shift from linear production to a circular economy.

The digital sector will also contribute to the European Green Deal, both as a source of clean technology solutions and by reducing its own carbon footprint. Scalability is key in a digitalised economy, so strengthening the digital single market will underpin Europe’s transition. Europe must also speed up investment in research and the deployment of technology in areas such as AI, 5G, data and metadata management. 5G private networks will become into the industry and at the same time hybrid clouds will enable networks that are sharing content and resources seamlessly. This will be required by Web 4.0 smart services and things: goal oriented intelligent connection of semantic resources. Connectivity will expand between systems and people. Personnel at the mill level will be more aware and artificial knowledge from the cloud will be nearby all the devices, sensors and processes to the human. This can be made more accurate, for example, with precision time protocol (PTP) support on hardware level (industrial devices at least) to get better indoor location (time of flight).

European factories and machines already have a high level of automation and digitisation. Many of the leading end-user companies are European based, and Europe also has a number of significant system and machine building, engineering and contracting companies that have a competitive edge in automation and digitisation. The business environment is changing. Through specialisation in new or niche end products, production is becoming more demand-driven and agile, while production is increasingly geographically distributed. In addition, the outsourcing of auxiliary business functions such as condition monitoring and maintenance is gaining in popularity, leading to highly networked businesses. There are many opportunities for energy, waste, material, recycling optimisation, etc., over the value chains and across company boundaries. Such advantages can only be realised by having a significant increase in digitisation.

This transition should include the adoption of applications that do not require to be kept internal or confidential, as solutions based on web/cloud services allows for the mediation of key factors such as their use by non-AI professionals, and off-line development of advanced criteria models and inferential engines through the expertise of specialised centres.

The exploitation of AI for core business functions generally requires a complete rethinking of data management and their use and tracking inside the supply chain. Instead, the implementation of a System of System (SoS) framework enables the data to be to capitalised on through appropriate actions, in which analysis and analytical tools usually reach their limits. Interaction between systems will be more direct (knowing neural nets). This will require more interfaces that will enable adaptive connectivity with access rights (part of information will remain always hidden). This enabled finally real predictions.

Industrial Metaverse will speed up training of employees. It will enable simulations before actual building physical system. It can be used to help field workers with AR/VR. Even product design collaboration around the world will come possible. Virtual designs will enable building physical products and vice versa: adding digital assets from physical items.

The actual value chain will come from existing installations, as it is unusual for new factories to be built. As new, fast and secure communication protocols will provide easy connectivity and interoperability across systems; this will enable the potential for extensive integration. Easy access to a secure internal network will provide all existing information to users at anytime and anywhere within the plant. Moreover, new interesting features could be accessed through cloud or edge-based computing systems. However, this will require new hardware infrastructure to be added to the plant, along with greater processing power to handle larger amounts of data. ![]()

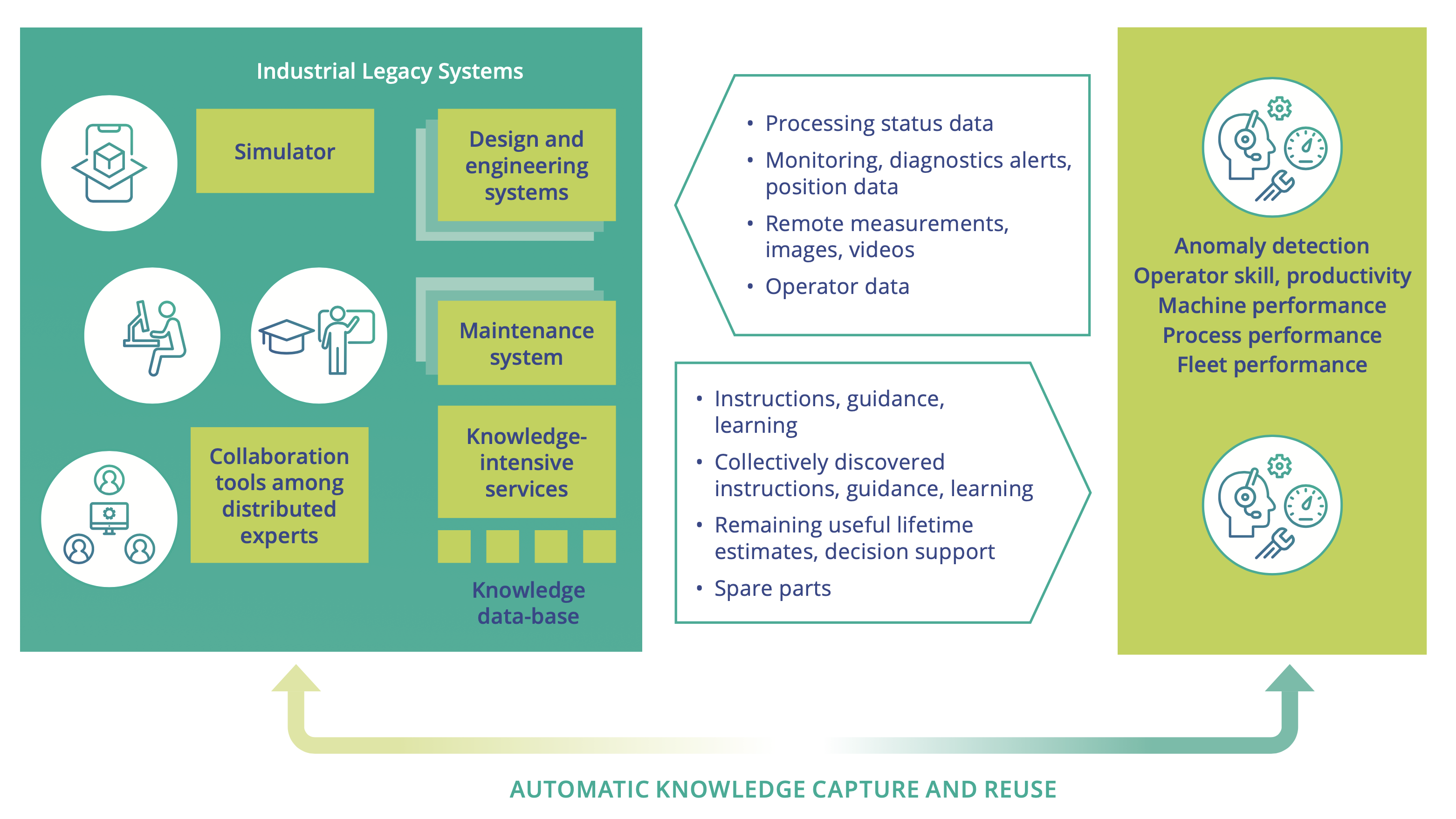

Digital infrastructure and micro services will help evolve business models towards selling added value as a service. Investment in projects will create networks between vendors and providers. In modern business- to-business (B2B) relationships, ongoing R&D and industrial pilots will aim to deliver a range of after-sales services to end customers. Typically, such services will include condition monitoring, operations support, spare parts and maintenance services, help desks, troubleshooting and operator guidance, performance reporting, as well as the increasingly required advanced big data analytics, prognostics-based decision support, and management information systems.

Industrial services often represent 50% or more of industrial business volume, and this share is steadily growing. The share of services is generally higher in high-income countries than in low-income countries. The importance of service businesses in the future is obvious, since they also enable sustained revenue after the traditional product sales, with the service business being typically many times more profitable than the actual product sale itself.

It is important here to note the view of manufacturing from the recent Science Europe report, “Guidance Document Presenting a Framework for Discipline-specific Research Data Management”:1

Europe is home to a competitive, wealth-generating manufacturing industry and of extremely comprehensive manufacturing ecosystems which accommodate complete manufacturing supply chains. Europe’s manufacturing industry is the backbone of the European economy, bringing prosperity and employment to citizens in all regions of Europe.

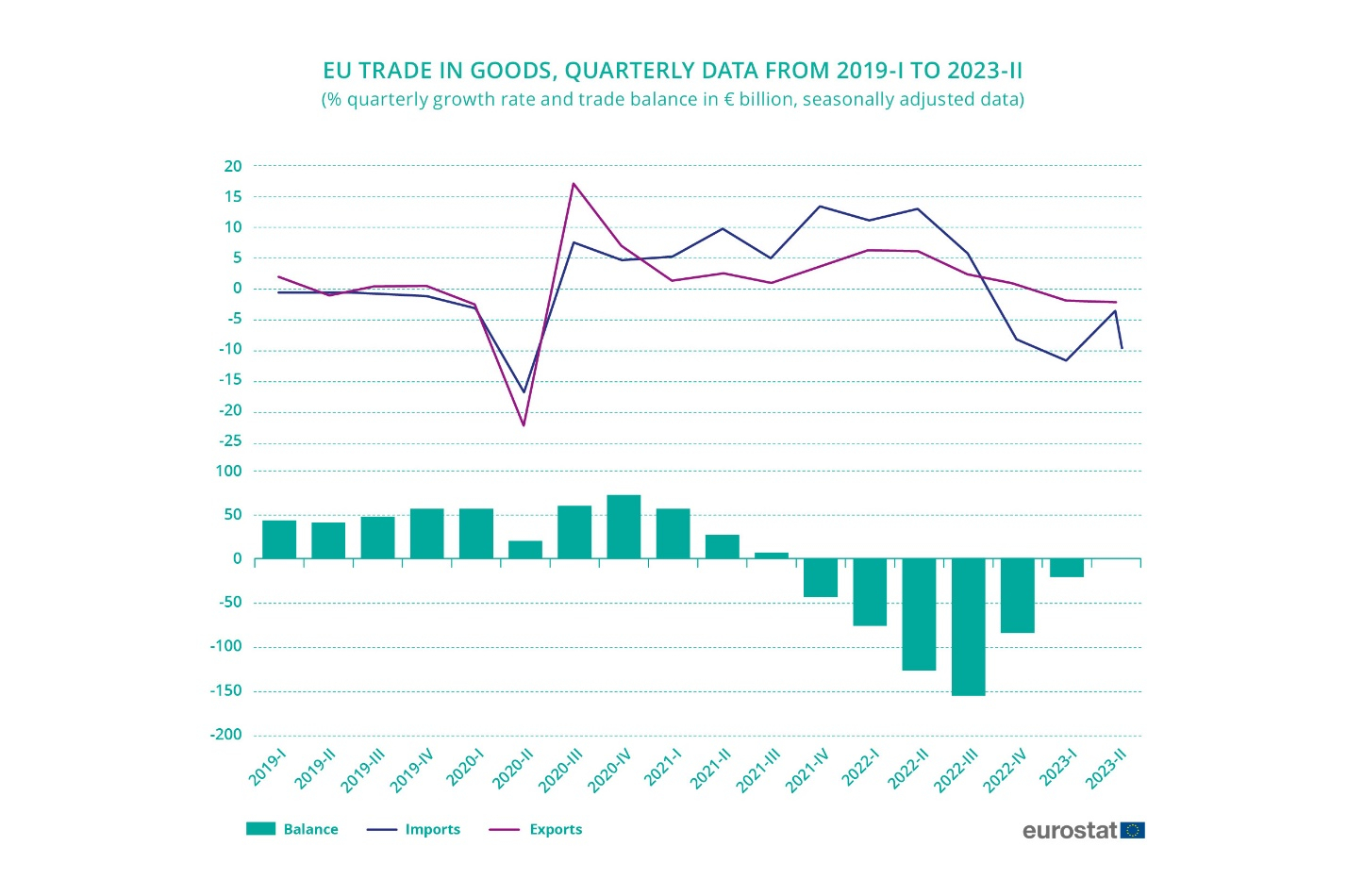

The EU is a global market leader for high-quality products, and European Industry is the world’s biggest exporter of manufactured goods, which represent 83% of EU exports. Thanks to the strengths of its manufacturing industry, the EU annually achieves a considerable trade surplus in the trade of manufacturing goods as depicted in the below diagram. This healthy surplus generated by the manufacturing industry allows the EU to finance the purchase of other, non-manufactured goods and services, such as raw materials, energy (oil and gas), and services. The surplus in manufactured goods thus compensates the deficits which are generated by purchasing non-manufactured goods. However, the surplus generated by EU’s manufacturing sector cannot fully compensate these deficits anymore: in the first three quarters of 2022 there was a significant increase in extra-EU trade, driven by rising commodity prices, in particular for energy and food, as the Russian invasion of Ukraine put additional upward pressure on these products. However, in the fourth quarter, exports only increased by 0.9% compared with the previous quarter while imports fell by 8.2% due to falling prices of energy products. In the first quarter of 2023 both imports and exports fell and this continued in the second quarter of 2023 when exports fell by 2.0% and imports by 3.5%. The trade balance improved from a deficit of €155 billion in the third quarter of 2022 to a trade surplus of €1 billion in the second quarter of 2023. From Q1 2019 to Q2 2022, as depicted in Figure 3.3.1, there has been a recovery in respect to the strong decline due to the COVID-19 pandemic and implications of the Russian invasion of Ukraine, both affecting the international situation. Nevertheless, even if imports increased a lot in 2021 and 2022, and even if exports are still decreasing, the balance is changed actually at the end of 2023 toward a potentially positive value next year..

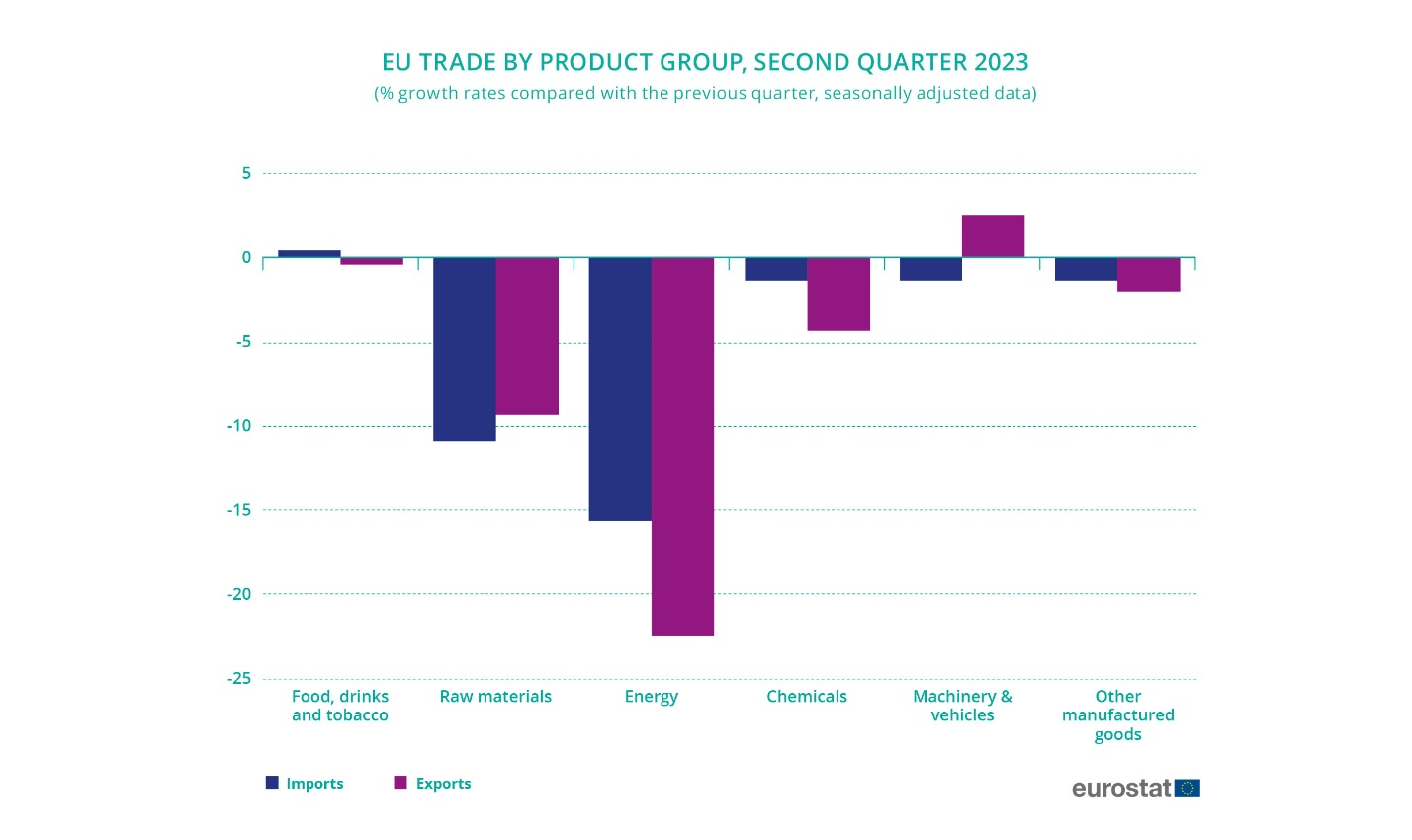

The decrease of extra-EU imports in the second quarter of 2023 was mainly due to the energy sector (-15.6 % compared with the first quarter of 2023) and raw materials (-10.9 %), as shown in Figure 3.3.2. With the exception of machinery & vehicles, exports also decreased in this exports report. The largest decreases were for energy (-22.5 %) and raw materials (-9.3 %)

Although Europe’s industry is a worldwide technology leader in most manufacturing market segments, this position is constantly being challenged by international competitors. While being highly competitive, statistics show that EU manufacturing industries constantly need to keep up with worldwide competition. Competitors, especially from Asian economies, have reached advanced levels, often supported by state-supported programmes and plans. Furthermore, industrial structures are changing with significant foreign investments, including those by emerging economies, in Europe and in the US. And finally, large-scale digitalisation, changes in trade rules, and global environmental concerns create new challenges, demanding EU industries to strongly invest in new technologies and reinforcing synergies internally to the EU rich supply chain.

In addition, it is worth noting the perspective of the recent P4Planet 2050 Roadmap of SPIRE, “Transforming the European Process Industry for a Sustainable Society”:4

Process industries are an essential part of the European economy. Process industries are crucial components of numerous value chains that deliver goods and services to our society and to European citizens. The materials produced by the process industries ultimately aid in providing shelter and housing to families, transporting passengers or freight, offering comfortable working spaces, producing and preserving food and beverages, and producing the sophisticated devices needed in modern healthcare and high-tech digital world. In other words, process industries enable the life we are living. Currently the process industry provides about 6.3 million jobs directly and 19 million indirectly. Process industries continuously attract talent and incite academia to train the next generation of experts. Process industries contribute about €565 billion/year to GDP, drive innovation, and develop solutions for societal problems.

Focused innovation efforts will transform the European process industries. The process industries will adapt existing processes and develop disruptive new mainly digital processes to fulfil the needs of this society in transition, both in the short and the longer term. New solutions (both technical and non-technical) are crucial. As major technological challenges are similar across process industries, increased collaboration is needed inside EU industrial supply chain in a empowered Edge-to-Cloud Continuum landscape. Europe and its process industries can only succeed in solving the puzzles of climate change and circularity if they jointly define and implement ambitious research, innovation, industrial and financing policies enabling fast and smooth transitions.

As many process industries compete on a global playing field, the competitiveness of these industries needs to be safeguarded throughout the transition. The transformation of EU process industries requires unprecedented levels of investments. If new technologies come at higher cost without a predominant EU ownership, there is a risk that European process industries lose their competitiveness. This needs to be avoided through an effective policy framework, but competitiveness can also be boosted by innovation and scale (e.g. driving down cost of process technologies or of inputs).

Six Major Challenges have been identified for the Digital Industry domain:

- Major Challenge 1: Responsive and smart production.

- Major Challenge 2: Sustainable production.

- Major Challenge 3: Artificial Intelligence in digital industry.

- Major Challenge 4: Industrial service business, lifecycles, remote operations and teleoperation.

- Major Challenge 5: Digital twins, mixed or augmented reality, telepresence.

- Major Challenge 6: Autonomous systems, robotics.

3.3.4.1 Major Challenge 1: Responsive and smart production

Responsiveness, flexibility and smartness is currently considered inside the European productive landscape based on pre-Industry 4.0 automation technology. At the same time, in addition to the critical situations to be handled, European Industry must be much more responsive to any changes that may occur, not only from a scientific and technological point of view.

Today’s automation solutions are not inherently flexible by design.

Adaptive and self-learning systems principles must be applied to automation solutions, enabling the automation system and solution flexibility, responsiveness and smartness.

Many European initiatives and reports cover this topic:

-

MADE IN EUROPE INITIATIVE with its SRIA5 prepared by European Factories of the Future Research Association (EFFRA6) name as a key priority: the Agile and robust optimal manufacturing towards “… sustainable manufacturing in Europe based on joined expertise and resources. It will boost European manufacturing ecosystems towards global leadership in technology, circular industries and flexibility. The Partnership will contribute to a competitive, green, digital, resilient and human-centric manufacturing industry in Europe. It will be at the centre of a twin ecological and digital transition, being both a driver of, and subject to, change.

-

SMART-EUREKA7 envisions enhancing “the current strengths of the EU discrete manufacturing sector with its leading capabilities and technologies in simulation, modelling, automation, processing and servitising.

-

ManuFuture8 claims that “the European manufacturing system in 2030 must be resilient and adaptive to cope with a rapidly changing and unpredictable environment, overcome disruptions and adapt to meet the changing market needs”. In their 2023 report 9, the World Manufacturing Foundation calls to “Digital, Data Driven, AI Based, Mass Customization, Servitised and Circular Business Models

The main benefits of a more responsive and resilient production are:

-

Ability to forecast the evolution of the demand-offer-competition ecosystems

-

Capability to rapidly change production and provisioning.

-

Efficiency to become profitable with high-mix, low-volume production.

-

Capacity to operate, even with decreased operational capability.

-

Enable rapid concrete innovation, not exclusively via rapid integration and product evolution but also re-engineering the overall process and components production.

-

Limit deterioration in performance, reliability, maintainability and interoperability when plants face disturbances.

Chips JU will play a lead role in this evolution to more responsive, robust and resilient factories. From sensors integrated in wearables and prosthetics, to SOS that enable self-healing and self-reconfiguration, responsive and resilient manufacturing has always been an important challenge.

AI will also play a key role in increasing the flexibility of manufacturing systems. One example is AI applied to real-time scheduling that allows a production process to flex around rush orders and disturbances in the line or supply chain. However, while the current trend of deep learning is opening up limitless possibilities in some areas, there is a need to apply other AI approaches that are more explainable, more aware of the environment and the task at hand.

The impact of Covid-19 and recent war in Ukraine with the worldwide impacts expected for the future years has highlighted many of the reasons why a flexible factory needs to adapt better in times of change to be a more useful part of the European response to such crises by:

-

Modifying production based on medical needs and exogenous inputs.

-

Scheduling production with less human resources and social distancing constraints.

-

Empowering agile working and telepresence.

-

Adapting to changes in the supply chain, promoting European independence.

-

Developing capacity for in-kind, or inside a shorter supply chain for the production of components that usually come from the worldwide market-based supply chain.

-

Developing capacity for redesign and re-engineering, due to lack of raw materials and electronic components.

Although automation and digitisation are the building blocks for building a flexible, resilient manufacturing industry, the importance of a well-trained and agile workforce cannot be overestimated. Workforce agility and flexibility, achieved, for instance, through cross-skilling, empowered by smart technologies like AR and VR, make humans indispensable in any production process.

In terms of standardisation, standards are a significant and necessary part of all industrial applications. The modern digitalisation of industry could not exist without standards, as without standards interoperability would not be possible. They enable extensive industrial projects while ensuring quality, safety and reliability. Many engineering methods are standardised, and provide textbook consistency across professional engineering. However, standards must also be supported by the relevant engineering tools, etc., as those required for design or development are different from those required at the operation stage.

-

Robust optimal production, scalable first-time-right production: future manufacturing plants should become more robust in the sense they can continue production even when facing a disturbance. This will require advances in, for example, self-healing and redundant automation systems, first-time-right, zero-defect manufacturing, and predictive maintenance empowering very adaptable production.

-

Mass customisation and personalised manufacturing, customer-driven manufacturing: progress in recent years towards lot-size-one manufacturing and personalised product design will continue to grow in the next few years: IoT sensors will self-correct for disturbances, real-time warehouse connectivity will allow to optimise the shop-floor, edge devices will perform predictive analytics. All of these advances will allow greater flexibility.

-

Resilient and adaptive production, including the shortening of supply chains and modular factories: Resilience is a critical property for systems that can absorb internal and/or external stresses and adjust their functional organisation and performance to maintain even with a reduced productivity the necessary operations. A resilient factory will continue to operate without any breaks to achieve its objectives under varying conditions and with the ability to overcome that stress to return to ordinary condition of functionality and productivity.

-

Cognitive production: This involves deploying both natural and artificial cognition alongside IoT devices and data analytics to enable new analytics and learning that can enable responsive and sustainable adaptable production. For example, real-time monitoring against lifecycle assessment (LCA) criteria can be facilitated by the implementation of AI. More generally, it is important for cognitive production to support the emergence of simplicity rather than the combinatorial growth of complexity when complex cyber-systems are combined with complex physical systems.

-

Manufacturing as a service: Technological advances have the potential to expand the geographical distribution of manufacturing and facilitate manufacturing as a service, MaaS (a well- known example is 3D printing). The trend to move part of labour-intensive production into high value manufacturing exploits MaaS, allowing to outsource parts of the production chain, replacing the need to have dedicated lines and even the whole factory (factory less goods). Another interesting opportunity for MaaS is moveable factories, which circumvent the need for new industrial infrastructure. The scope for moveable factories is enhanced by the range of manufacturing machines and power sources that are becoming increasingly small and light enough to fit into trucks, trailers, carry cases, etc. MaaS empower the dynamic aspects of outsourcing, provisioning, making the supply chain ecosystem more resilient.

-

Embedded/Edge/Cloud architectures: Nowadays system architectures mainly consist of three layers of computing devices, see Fig. 2.1.1 in Chapter 2.1. Embedded computing reside very close or attached to the machinery or process. Near Computing devices (2) are often called edge computers, routers, or local servers. Near computer nodes are powerful computers themselves and communicate both to the embedded computing cards and to the cloud (3) via internet. A special boost in the picture comes from the 5G technology. There, the 5G communication technology takes care of the edge-to-cloud and edge-to-edge communication which will be faster than anything before. The 5G base stations, called peripheral structures and/or edge nodes, are no longer mere antenna poles but equipped with very powerful computing nodes, and the densely installed 5G base stations will take the role of edge computers. Workload and services are moved from the centralised data centres (core network) to the proximity, benefiting mainly latency which is crucial for time critical application and services.

-

Standardisation: Due to the ongoing legacies of the many existing standards and their installed base (number of units of a product or service that are actually in use), focus should be on bridging the systems of the various standards. This should involve developing semantic technologies to master these diverse and numerous standards, including software or platforms that enable effective connectivity at a high application level, as well as respective digital testing, development environments and licencing. This is key to ensure there is wide acceptance and support of software vendors, engineering offices and end-users.

3.3.4.2 Major Challenge 2: Sustainable production

This Major challenge focuses on how Industry 4.0 should address the future regulation or market requirements emerging from the European Green Deal and zero-carbon (or below carbon-neutral) operations.

Nearly 200 countries have committed to the Paris Agreement on climate change to limit global warming to below 2ºC. The rapid transformation of all sectors is therefore required. In fact, many European countries have set even more ambitious targets, and Chips JU could have a great bearing in reducing environmental impact through sustainable manufacturing, including energy- and resource-efficiency and by applying circular economy strategies (eco-design, repair, re-use, refurbishment, remanufacture, recycle, waste prevention, waste recycling, etc).

There are some so-called rare earth metals to save, and any kind of careless materials usage can be proven uneconomical and risk to the environment. The vision of Sustainable Process Industry through Resource and Energy Efficiency (SPIRE) categorises the high-level goals discussed above into more practical action, as follows. ![]()

![]()

-

Use energy and resources more efficiently within the existing installed base of industrial processes. Reduce or prevent waste.

-

Re-use waste streams and energy within and between different sectors, including recovery, recycling and the re-use of post-consumer waste.

-

Replace current feedstock (raw material to supply or fuel a machine or industrial process) by integrating novel and renewable feedstock (such as bio-based) to reduce fossil, feedstock and mineral raw material dependency while reducing the CO2 footprint of processes or increasing the efficiency of primary feedstock. Replace current inefficient processes for more energy consumption reduction

-

Resource-efficient processes when sustainability analysis confirms the benefits.

-

Reinvent materials and products to achieve a significantly increased impact on resource and energy efficiency over the value chain.

ManuFUTURE Vision 2030 combines these objectives as shown in Figure 3.3.3.

-

Monitoring flows of energy, materials, waste and Lifecycle assessment: It is already commonplace in many industry sectors (food, medicine, etc) that material and energy streams need to be fully traced back to their starting point. As more and more products, raw materials, etc, become critical, this implementation strategy must be expanded. Flows need to be monitored. Sustainable manufacturing needs comprehensive environmental data and other measurements that may have been in place when the relevant manufacturing or production was initiated. On the other hand, this is a very typical application for many types of IoT sensor and systems that can be informed by careful LCA. LCA is a prerequisite for holistic environmental evaluation, and it is a simple but systematic method, that requires a mixed combination of extensive and comprehensive models and data.

-

Virtual AI assistants: Discharges or losses mostly happen when production does not occur as planned, due to mistakes, the bad condition of machinery, unskilled operation, and so on. Human factors cause most of the variation in the running of continuous processes. There should therefore be a focus on how an AI assistant or AI optimiser could be used to help operators by providing advice and preventing less than optimal changes.

-

Human–machine interfaces and machine-to-machine communications: Augmented reality (or virtual reality) will be used to support a number of tasks. Enhanced visualisation of data and analytic results will be required to support decision-making.

-

Human operators in more autonomous plants and in remote operations: the relationship between machines and the human factor needs to be rethought. In terms of the logic of human-machine interface, from touch displays, to wearable devices and augmented reality, but also to maintain the centrality of the human factor within the new contexts. The “Skills 4.0” are necessary for the management of new technologies for data administration, for privacy, for cybersecurity and much more.

-

Human safety: With the localisation of personnel, machines and vehicles, situation-aware safety (sensing of safety issues, proximity detection, online human risk evaluation, map generation, etc) will become increasingly vital.

-

Competence and quality of work in a human-centred manufacturing: At a strategic level, the European automation and industrial IT industry depends on its ability to attract skilled personnel to maintain their competence over time. A higher level of formal training may be required for workers in production and maintenance. Greater specialisation is constantly introducing products and processes that require greater company-specific training.

-

Green Deal: Policy initiatives aimed at putting Europe on track to reach net-zero global warming emissions by 2050 are key to the European Commission’s European Green Deal. The Commission the highly challenging objectives of the Green Deal, all industries must focus on high efficiency, low energy usage, carbon-neutrality or zero-carbon usage, zero waste from water, soil and air – all measured, calculated or estimated on product, factory, global and lifecycle levels. European industry must research and discover new materials while paying a great deal of attention to recycling, re-use, and de- and re-manufacturing. NOTE: New RICS-V based computing hardware will be needed to reduce energy used at data centres. Extra 3 x performance will be gained compared to ARM Cortex-A75.

Many of these advances will require extensive development in the other engineering, business or social domains, even at the individual level, that are outside of the Chips JU focus. However, it is also obviously the case that a growing part of these approaches will be implemented through the significant help of electronics and software technologies. The need for Chips JU technologies is diverse, and it is not useful to indicate one single technology here. High performance, high precision, careful and professional engineering and decision-making are needed – often at a much higher level than today.

3.3.4.3 Major Challenge 3: Artificial Intelligence in digital industry

Major challenge 3 focuses on connected and smarter cyber-physical systems (CPS), industrial internet, big data, machine learning and AI. Local edge-based intelligence is seen as an opportunity for Europe. AI optimised and Open hardware becoming more important to support European AI Framework. This Major challenge extends toward AI-enabled, adaptable, resilient factories, including the human as a part of a “socio-technical” system. AI in combination with (predictive) condition monitoring and maintenance will be applied to not only support reconfigurable first-time-right/zero-defect manufacturing, but also to support human decision-making (considering uncertainties), as well as enabling resilient manufacturing ecosystems based on new business models, increasing safety & security in working environments and improving productiveness and quicker return from investments. In this context, Explainable AI (XAI) is another an emerging field for better understanding of decision making to increase human trust. An important challenge here is to lead not only the digital transformation of Industry 4.0, but also the next generation of Chips JU platforms supporting AI-driven human-centric autonomous Industry 4.0 operations. Condition monitoring techniques can be applied to many types of industrial components and systems, although often at additional cost. Commonly, the business value required from condition monitoring depends on the higher availability of equipment and, for production processes, information provision to be able to plan and act on maintenance proactively instead of reactively, as well as to offer decreased cost and improved on-time delivery. Other business values that may be of interest are safety and the optimal dimensioning/distribution of spare parts and maintenance staff. Thus, serious breakdowns and unplanned interruptions to production processes can largely be avoided using condition monitoring.

AI will impact several main areas, all of which are relevant to Digital Industry improving:

-

Productivity, by exploiting AI in the design, manufacturing, production and deployment processes.

-

Flexibility, by using AI throughout the value stream, from supply to delivery, increasing the autonomy and resilience of each process in the value chain.

-

Customer experience, by using AI to make products faster and with better quality, and to provide more efficient services.

-

Assistance to human operators in circumstances of rising complexity by using AI to support the decision-making process with ever-increasing levels of complexity and dynamics.

These fundamental impacts will be experienced in all areas of every market sector. In manufacturing and production, AI will deliver productivity gains through a more efficient resources, energy and material use, better design and manufacturing processes, and inside products and services, enhancing their operation with more refined contextual knowledge.

The agenda here is cross-sectorial, focusing on AI applied in any domain. However, the impact of AI in Digital Industry is of particular significance. Manufacturing is in one of the three top industries for AI investments in 202111

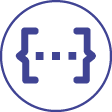

European AI framework

Figure 3.3.4 sets out the context for the operation of AI public/private partnerships (PPPs), as well as other PPPs or joint undertakings (JUs). It clusters the primary areas of importance for AI research, innovation and deployment into three overarching areas of interest. The European AI framework represents the legal and societal fabric that underpins the impact of AI on stakeholders and users of the products and services that businesses will provide. The AI innovation ecosystem enablers represent essential ingredients for effective innovation and deployment to take place. Finally, the cross-sectorial AI technology enablers represent the core technical competencies that are essential for the development of AI systems.

AI in manufacturing

-

AI for dynamic production planning and management: This involves taking real-time decisions to optimise the factory operation by quickly modifying the productions schedule, based on the current state of the shop floor, predicted sales orders, unexpected events such as machine breakdowns or changes in job priorities, etc.

-

Virtual models spanning all levels of the factory life and its lifecycle: A holistic and coherent virtual model of the factory and its production machinery will result from the contribution and integration of modelling, simulation and forecasting methods and tools that can strategically support manufacturing-related activities.

-

AI for green/sustainable manufacturing: The development of software-based decision-support systems, as well as energy management, monitoring and planning systems, will lead to overall reduced energy consumption, more efficient utilisation and optimised energy sourcing.

-

AI applied in supply chain management: Planning and managing logistics for real-time operations, collaborative demand and supply planning, traceability, and execution, global state detection, time-to-event transformation, and discrete/continuous query processing would therefore be a challenge in view of the distributed nature of these elements.

-

AI for advanced manufacturing processes: The ability to design functionality through surface modifications, functional texturing and coatings, enabling improved performance, embedded sensing, adaptive control, self-healing, antibacterial, self-cleaning, ultra-low friction or self- assemblies, for example, using physical (additive manufacturing, laser or other jet technologies, 3D printing, micromachining or photon- based technologies, physical vapour deposition, PVD) or chemical approaches (chemical vapour deposition CVD, sol–gel processes) will deliver high functionality and hence high-value products.

-

AI for adaptive and smart manufacturing devices, components and machines: Embedded cognitive functions for supporting the use of machinery and robot systems in changing shop floor environments. Open Hardware based AI solutions will also support European AI Framework

AI for decision-making

Decision-making is at the heart of AI. Furthermore, Explainable AI will increase “human-centric” approaches in autonomous industry.

-

AI can support complex decision-making processes or help develop hybrid decision-making technologies for semi-autonomous systems.

-

Human decision-making, machine decision-making, mixed decision-making and decision support.

-

Sliding or variable decision-making, dealing with uncertainty.

-

AI for human interaction with machines.

-

AI for control technologies.

-

AI for monitoring services.

-

AI for maintenance systems for increased reliability of production systems.

-

AI services for continuous evaluation and mitigation of manufacturing risks.

-

AI for quality inspection.

3.3.4.4 Major Challenge 4: Industrial service business, lifecycles, remote operations and teleoperation

The volume and value of industrial services are increasing by between 5% and 10% every year. The share of services has exceeded the share of machinery for many machines, system and service vendors – not just for a final assembly factory, but also for companies in supply chains. Companies are willing to take larger shares of their customers’ businesses, initially as spare part suppliers, but increasingly for remote condition monitoring, as well as extending this to a number of those tasks previously considered as customer core businesses. From a customer point of view, such a shift in business models lies in the area of outsourcing.

Industry as services is changing the production through use of externalisation moving local tasks to external and ever more specialised providers, benefiting of greater flexibility, resilience and adaptability on production; a new proposition of supply chain is embedding all production phases, from the procurement of raw materials and semi-finished products up to the customer services and/or the design of parts or whole final product.

While many businesses have become global, some services are still provided locally, at close to customer’s locations, while other services are provided centrally by the original vendor or companies specialised in such services. Similarly, as there may be extensive supply chains underpinning the vendor companies, the respective services may also extend to supply chain companies. The industrial era is becoming a service era, enabled by high-end Chips JU technologies. This distributed setting conveniently fits into modern edge-to-cloud continuum innovative architectures as computing power engines and infrastructures enabling emulation, training, machine learning and communication platforms enabling real-time interconnections. ![]()

The importance of service businesses to the future is evident as they enable a revenue flow beyond traditional product sales, and more importantly they are typically much more profitable than the product sales itself.

The service business markets are becoming more and more challenging, while high income countries are focusing on the high-skilled pre-production and lifecycle stages. Fortunately, in the global service business market, Europe can differentiate by using its strengths: a highly skilled workforce, deep technology knowledge and proven information and communications technology (ICT) capabilities. However, to ensure success it needs new innovations and industry-level changes.

Remote operations, teleoperation ![]()

-

Remote engineering and operations, telepresence: Operating or assisting in operations of industrial systems from remote sites.

-

Edge/cloud solutions: Implementing distributed service applications on effective edge cloud systems.

-

5G with very low latency will be used for remote operations.

AI Services for monitoring and collaboration

-

Collaborative product-service engineering, lifecycle engineering: Extending R&D to take into account how products and systems will be integrated into the industrial service programme of the company. This should possibly be enhanced by obtaining further knowledge to provide services for other similar products (competitors!) as well their own installed base.

-

Training and simulation: Complex products such as aircrafts, drones, moving machines and any tele-operated machineries need a simulation environment for proper training of the human driver/operator.

-

Condition monitoring, condition-based maintenance, anomaly detection, performance monitoring, prediction, management: The traditional service business sector is still encountering major challenges in practice. It will therefore require an extension to the above, as targets of services are expanded to other topics in customer businesses in addition to spare parts or condition monitoring.

Fleet management, Edge and local/global decision making

-

Decision and operations support: In most cases, decision-making is not automatic, whereas in the future it could be based on remote expert assistance or extensive diagnosing (AI-based, etc), engineering, and knowledge management systems.

-

Fleet management: This could benefit on the basis of sold items, by obtaining knowledge and experience from range of similar components and machines in similar or different conditions.

Business services integration

-

Local and global services: Organising services locally close to customers and centrally at vendors’ sites.

-

Full lifecycle tutoring: Monitoring activities, level of stress and performance-oriented behaviour during the product’s life, from anticipating its end of life to properly handling its waste and recycling, including improved re-design for the next generation of products.

3.3.4.5 Major Challenge 5: Digital twins, mixed or augmented reality, telepresence

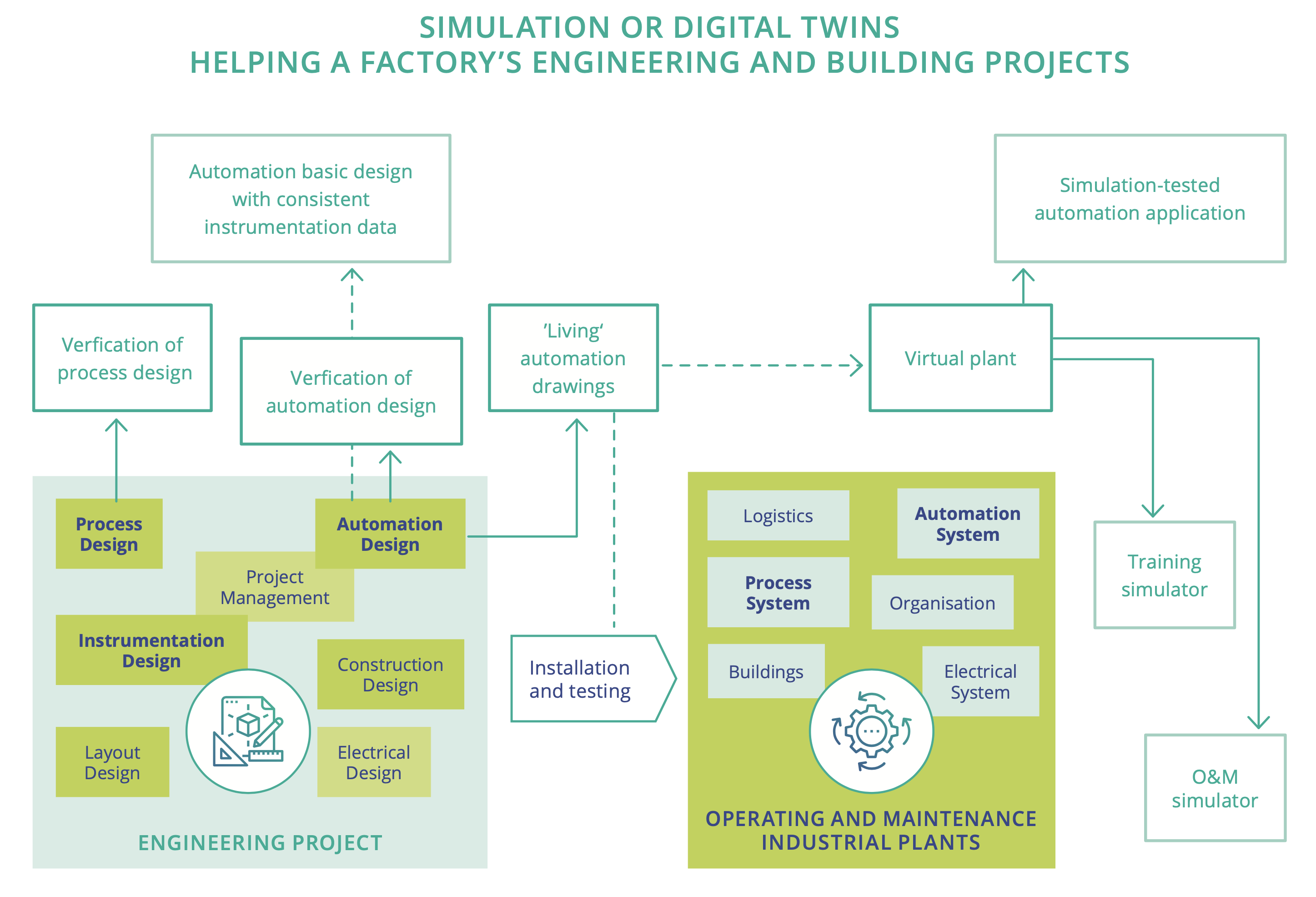

A “digital twin” is a dynamic digital representation of an industrial asset that enables companies to better understand and predict the performance and behaviour of their machines, and also to find new revenue streams. Currently, connectivity to the cloud allows an unprecedented potential for the large-scale implementation of digital twin technology for companies in various industries. A physical asset can have a virtual copy running in the cloud, increasing revenue through continuous operational data.

Simulation capability is currently a key element in the European machine tool industry’s attempt to increase its competitiveness. In the Industry 4.0 paradigm, modelling plays a vital role in managing the increasing complexity of technological systems. A holistic engineering approach is therefore required to span the different technical disciplines and provide end-to-end engineering across the entire value chain. ![]()

In addition to virtual commissioning, modelling and simulation can more widely respond to many digitalisation challenges:

-

visualising physical or real-world phenomena of products, production, businesses, markets, etc.

-

helping designers to perform their core tasks – i.e., studying alternative designs, optimising solutions, ensuring safety, and providing testing for automation and Internet of Things (IoT) solutions.

-

The effects of changes can be safely and more comprehensively assessed in advance in a virtual domain rather than using real plants, equipment or even mock-ups.

-

Simulators offer versatile environments for users or operator training.

-

It is evident that former computer-aided design (CAD)-driven digitalisation is shifting the focus towards simulation-based design.

Simulators may be used online and in parallel with its real counterpart to predict future behaviour and performance, provide early warnings, outline alternative scenarios for decision-making, etc., although they have years of research behind them, such tracking simulators are to be co-designed and improved exploiting also recent investments in computing infrastructures (e.g. HPC EU families, EPI initiative), with a special focus on the industrial context.

Telepresence technologies can also be considered as the predecessor for an extended reality (XR) presence. The combination of new and advanced technology like e.g. XR, AIoT, Edge, HPC, 5G and open integration platforms offers significant potential for innovation, which would benefit the evolution of European digital industry. ![]()

As an example, XR is a combination of virtual and augmented reality, and an XR presence is a continuum between a physical reality presence and a virtual reality presence. The main driver here is improving competitiveness through better productivity, more effective worker safety and better quality. The industrial applications have followed the prospects offered by the gaming industry and consumer applications. One of the reasons for its increased take-up is the declining cost of electronic components and sensors.

As some major smart glass producers will provide technology and a platform for consumers, other EU industrial groups could do the same, and the EU industrial ecosystem could take benefit of such devices and provide industrial use cases. These can be extended then to state-of-art applications. Back-end services are Digital Twins and Condition Monitoring systems that will provide critical and useful information for the Field Worker. Longer vision for the integration human actions and back-end data servers can be used to build knowledge graphs to help other users to work like experts. As a summary; smart glasses can extend human understanding and knowledge if services and information flow can be utilised and formed to usable knowledge. ![]()

Digital Twin: Design process digitalisation, telepresence

-

Heterogeneity of systems: Information sharing and standards and means to ensure interoperability of digital twins and their information sources are important to facilitate information synchronisation. Having all relevant engineering disciplines (processes, assembly, electronics and electrical, information systems, etc.) evolving together and properly connected over the lifecycle phases is therefore crucial. This also involves multi-domain simulation, joint simulation of multi-simulation systems coupling.

-

Immersive telepresence for industrial robotics from design toward production lines and any other operational scope.

-

Digital twins applied to sustainability and circular economy: Simulate the usage of energy, use of raw material, waste production, etc., with the goal of improving energy efficiency and circular economy performance.

Virtual commissioning, interoperability:

-

Virtual commissioning: Digital twins applied to virtual commissioning to bring collaboration between different disciplines and models from domains of engineering (mechanic, electronic, automation) in the same environment.

-

Interoperability: Applications cannot yet be used across platforms without interoperability.

Simulators: Tracking & Simulator based design

-

Tracking mode simulation: Model adaption based on measurements. Generating simulators automatically from other design documentation, measurements, etc. Generation of simulators from 3D, data-driven models, etc.

-

Simulator-based design: Digital twin for testing the designed model by replacing the required physical components with their virtual models. This offers continuous design improvement (the digital twin provides feedback and knowledge gained from operational data), design optimisation, etc.

Digital twins combined with data-driven models (knowledge and data fusion):.

-

Combination of data-driven and knowledge-based models along the complete lifecycle (product and production). The real challenge is to combine physics and knowledge-based models (digital twins) with data- driven models (models created using AI from massive acquired experimental data), capitalising on the strength of information present in each of them.

-

New ways to generate large 3D scenes have been based, for example, on NeRF (Near Radial Field) and/or the Gaussian Splats.

Humans & Knowledge integration:

-

Human-in-the-loop simulations: Methods and simulations for human-in-the-loop simulations and integration of digital twins in learning systems for workers.

-

The 3D Internet platform: to integrate all of the aforementioned aspects into a single powerful networked simulation for humans to get the Situational Awareness for an industrial process as a whole.

-

Live 3D Digital Twins: to provide the state awareness (animation & color etc.) in AR/VR/XR.

3.3.4.6 Major Challenge 6: Autonomous systems, robotics

Machines are usually more precise and efficient than humans when carrying out repeatable tasks. Thus, replacing or aiding work processes susceptible to human errors, quality defects and safety issues with machines will have an impact on quality and redundant waste. The application of AI in robotics and the same robotics without AI extends the opportunity for automation of manual tasks, increasing the sustainability, safety & security of the production and its green transition. This will reduce the environmental impact -efficient reduction of the waste and optimise product quality toward zero-defect, process, and manpower. This will also achieve a more safe and secure working area to ease the human-machine, and machine-machine coworking.

There are many kinds of autonomous systems, robots and working machines. Just to give an insight into their widespread adoption, can be categorised by purpose, as follows:

- Industrial machines and robots:

- Manufacturing (e.g. welding, assembling, spray gun robots).

- Material handling (e.g. conveyors, warehouse robots, trucks).

- Consumer robots:

- Domestic (e.g. robotic lawn mowers or vacuum cleaners).

- Care (e.g. lifting or carrying robots).

- Healthcare and medical robots:

- Robotic surgery, hospital ward automation.

- Medical tests and hospital care, remote healthcare.

- Medical imaging, exoskeletons.

- Moving machines:

- Mining machines (e.g. drilling machines, dumpers, conveyors).

- Forestry (e.g. forest harvester), agriculture (e.g. tractors, appliances).

- Construction (e.g. excavators, road graders, building robots).

- Logistics and sorting centres (e.g. cranes, straddle carriers, reachers, conveyor belts, sorting machines, trucks).

- Military robots and machines.

- Transport:

- Vehicles, trucks and cars, trains, trams, buses, subways.

- Aviation (e.g. aeroplanes, helicopters, unmanned aerial vehicles, UAVs).

- Marine (e.g. vessels, ships, auto-piloted ships), submarine (e.g. auto-piloted submarines).

- Utilities and critical infrastructures:

- Extraction (e.g. drills for gas, oil).

- Surveillance (e.g. quadcopters, drones).

- Safety, security (e.g. infrared sensors, fire alarms, border guards).

- Energy power plants sensors and actuators (e.g. production and distribution).

- Transportation (e.g. moving bridges, rail exchanges).

The main aims and evolution trends of robots and autonomous systems in digital industry are oriented toward:

-

Production efficiency, speed and reduced costs,

-

Higher precision and quality, safety in working conditions,

-

To scale up “smart and high-end manufacturing”.

As is evident from the above, robots and machines and in particular autonomous systems are involved in all application chapters of this SRIA in addition to Digital Industry – i.e. Digital Society, Health and Wellbeing, Mobility, Energy, and Agrifood and Natural Resources- and are positively impacted by any improvement on both technological layers of the SRIA; foundational and cross-sectional technology. ![]()

![]()

![]()

![]()

There is undoubtedly a move to increase the level of automation and degree of digitalisation in industry, which will ultimately lead to fully autonomous systems.

However, between low and high technology manufacturing (two extremes: entirely manual and fully autonomous), there will always lie a large area of semi-autonomous equipment, units, machines, vehicles, lines, factories and sites that are worth keeping somewhat below 100% autonomous or digitised. The reasons for this include:

-

A fully autonomous solution may simply be (technically) near to impossible to design, implement and test.

-

If achievable, they may be too expensive to be realised.

-

A fully autonomous solution may be too complex, brittle, unstable, unsafe, etc.

-

A less-demanding semi-automatic solution may be easier to realise to a fully satisfactory level.

When the extent of automation and digitalisation are gradually, reasonably and professionally increased, often step by step, they may bring proportionally significant competitive advantages and savings that strengthen the position of digital industries overall. However, since the extent of automation and digitalisation remains well below 100%, any potential negative effects to employment are still either negligible or non-existent. On the contrary, the competitive advantages due to the adoption of robotics and autonomous system solutions increases the market positions of companies and, generally, enhances the need for more people in the respective businesses.

Advances in Artificial intelligence made it easier to achieve fully autonomous systems solutions, exploiting the automation of knowledge and service work into operative physical layers on different application domains, in which to automate work tasks. This is increasingly reducing the need for human intervention and, at the same time, allowing to highlight additional innovative functions, such as in automotive in which more autonomous vehicles are expected to play a key role in the future of urban transportation systems. Such a challenge in a so complex scenario will promote significant advances in any autonomous functions of the many systems which are integral part of the Digital Industry ecosystem.

Autonomous robots are key enabling systems towards implementation of autonomous functions shopfloors. Immediate benefits will be additional safety, increased productivity, greater accessibility, better efficiency, and positive impact on the environment. Here follows a modified picture from giving a generalised view of autonomous systems technologies and functionalities focused on autonomous vehicles, but with a rich affinity with any sort of autonomous system required building blocks.

The following picture shows matching of ISA95 standard that define control functions and other enterprise functions with building blocks of autonomous systems. The autonomy is expected to increase in the level 2 and Level 3 of ANSI/ISA9513.

Safety and security in autonomous systems:

Current standards of safety requirements for autonomous machines categorise safety into four approaches.

- On-board sensors and safety systems for machines that work among humans and other machines but is restricted to indoor applications.

- An isolated autonomous machine that works in a separated working area, mostly an intensive outdoor environment where other machines or humans are monitored.

- Machine perception and forecast of expected and/or unexpected human activities aimed at:

- (i) assisting human activities and movements with a proactive behaviour;

- (ii) preserving human health and safety;

- (iii) preserving the integrity of machinery.

- An operator is responsible for reacting to a hazardous situation encountered by the autonomous machine when being provided with enough time between alert and transferring responsibility.

Requirements management and conceptual modelling of autonomous systems:

With the increasing complexity of autonomous functionality in both AV and ADAS systems, traditional methodologies of developing safety critical software are becoming inadequate, and not only for autonomous driving, but in any industrial field of application of autonomous systems. Since autonomous systems are designed to operate in complicated real-world domains, they will be expected to handle and react appropriately a near endless variety of possible scenarios, meeting expectations from various stakeholders such as the internal engineering teams, people involved in the autonomous systems managements (e.g. passengers, drivers, workers, e-Health patients), regulatory authorities, and commercial autonomous vehicles/robots fleet operators.

Human–machine interaction in autonomous systems:

Improvements on sensing capabilities, on actuation control, IIoT and SoS distributed capability are, in robotics and autonomous systems, the key enabler for:

- Human–robot interaction or human–machine cooperation.

- Transparency of operations between human and advanced machine systems (AMS) in uncertain conditions.

- Remote operation and advanced perception, AS oversight and tactical awareness.

- Autonomy intended to enhance human capabilities.

- Natural human interaction with autonomous systems.

- Assisted, safety-oriented and proactive robot interaction with humans.

Digital design practices including digital verification and validation (V&V):

- Automatic or semi-automatic V&V.

- A digital design environment, digital twins, physical mock-ups.

- Sub-task automation development, generation of training data and testing solutions and field data augmentation, according to a handful of global machine manufacturers.

- Machine state estimation (assigning a value to an unknown system state variable based on measurements from that system).

Simulators and autonomous systems:

- Process model based and product 3D-models approaches, environment and object models, and simulation tools.

- Early design phase simulators.

- Robotic test environments.

- Empirical or semi-empirical simulators, making use of both real and simulated data collected from previous experiments.

- Off-road environments.

Autonomous capabilities development in a digital environment

- Autonomous decision taking.

- Self-evolving capabilities.

- Exploitation of knowledge in cognitive flexibility and in adaptability of the reaction.

The most obvious requirement for Digital Industry is the availability of all technologies, components and systems as described in other parts of this document both as foundation technologies and cross-sectorial areas serving and enabling the European Digital Industry mission.

It is extremely important that also a number of societal and policy needs are met, particularly the following aspects of EU legislation, related to working environments:

-

Adoption of trustworthy, responsible AI, XR and robotics.

-

To foresee exploitations of next generation HW architectures and new chip design (e.g. RISC-V, PIC).

-

Adoption of any type of technology safeguarding safety and security of workers.

and the following aspects related to EU policies for the promotion of:

-

Resilience of EU production capabilities and supply chain towards Industrial EU sovereignty.

-

Sustainability of EU manufacturing renovation and evolution towards a greener and safer EU.

-

Digitalisation of EU Industry towards a quicker and better Innovation vocation, cost production and energy consumption saving and capacity to forecast market and societal needs.

About engineering tools

Digital twins are commonly characterised by modelling and simulation (the finite element method, FEM, computational fluid dynamics (CFD), etc.) or by virtual or mixed reality techniques, and their numerous applications. However, the product processes, manufacturing design and management of the operative lifetime of a product or factory is much broader. Typical examples of these are: managing the multi-technologies (mechanical, electronics, electrical, software); safety, security and reliability engineering; managing interactions with the contexts of the target (humans, environment); managing testing and quality; the various types of discharges or footprints; managing projects, logistics, supply chains, etc. These tasks are increasingly being managed by software tools and systems, and through the use of standards, regulations and engineering handbooks, which generally require extensive domain knowledge and experience. ![]()

![]()

The respective engineering disciplines are well distinguished, developed and understood. Key examples here – such as factory design, electronics design, engine design and car design – are well-known and significant as regards success. These disciplines are going through a tremendous and demanding digitalisation process, sometimes called the “other twins” to underline their importance and high value. A narrow focus on digital twins will certainly play a growing role in implementing the concomitant increase in types of “other twin”.

There is also a notable discipline called “systems engineering”, which describes both aspects and the whole of the instantiated subfields such as factory design and engine design. Similarly, many notable software tools – such as product lifestyle management (PLM), supply chain management (SCM) and CAD – are actually families of tools with significant versions for the actual subdomains: ![]()

![]()

-

Parallel joint engineering of products, processes, safety, security, cybersecurity, human factors, sustainability, circular factors, etc.

-

Mastering the deep linkage and complexities in multiple engineering domains and technologies, along with product and process lifecycles in the digital domain.

-

Multiplying the engineering extent, efficiency and quality in the digital world.

About trust, security, cybersecurity, safety, privacy

Increasingly, industrial technologies are being regarded as critical applications by law, meaning that extensive validation, verification, testing and licensing procedures must be in place. Security must also be embedded in all engineering tools, which strongly suggests that safety is not achieved by testing alone, but should be built or integrated into every lifecycle stage. ![]()

![]()

Security and cybersecurity are the other side of the coin in the distributed, remote or networked applications that contemporary communication technologies effectively enable. Lacking useful security could easily be a showstopper.

Since safety or security is difficult to achieve and prove, industries prefer to talk about trust and how they expect (and assume) safety and security will be in place for their business partners. Nevertheless, there must be no nasty surprises between trusted partners in terms of security issues.

As regards privacy, there is much idealistic urging by researchers, software enthusiasts, etc., for open data and open software from industrial actors. However, certain data must be kept private by law. In addition, critical applications have been sealed and protected once they have been finalised, otherwise their safety, security, functionalities, etc., cannot be guaranteed. Most industrial applications also involve a great deal of engineering effort and creativity, are very extensive and constitute the core asset of companies that must be protected. Competitive business situations could therefore result in a cautious attitude towards open data and software. Nonetheless, industries sometimes do not entirely know what data is beneficial to keep private, and what should be open. In the era of AI, it may be a challenge to know in advance what could be discovered, for example, in the vast amount of factory or machine data available. It is better to be safe than sorry! Open interfaces, standards, etc., are good examples of practical openness.

About digital platforms, application development frameworks and SoS

Analysis of the different roadmaps confirms that the platform landscape is still very fragmented, with open and closed, vertical and horizontal platforms, in different development stages and for various applications. There is a strong need for interoperability/standardisation and the orchestration/federation of platforms. The trend is towards agile, composable, plug-and-play platforms (also that can also be used by SMEs), and more decentralised, dynamic platforms supporting AI at the edge. In addition, future (ledger-based) technologies could provide common services on trusted multi-sided markets/ecosystems. ![]()

Existing gaps can still be found in the following topics.

-

Moving the focus to industrial and engineering applications. It is important to win the global platform game in various application sectors (which are strong today), and to effectively develop high-level outperforming applications and systems for actual industrial and business requirements.

-

Preparing for the coming 5G era in communications technology, especially for both its manufacturing and its implementation within the edge-to-cloud continuum.

-

Long-range communication technologies optimised for machine-to-machine (M2M) communication and the large numbers of devices – low bit rates are key elements in smart farming, for instance.

-

Solving the IoT cybersecurity and safety problems, attestation and security-by-design. Only safe, secure and trusted platforms will survive in industry.

-

Next-generation IoT devices with higher levels of integration, low power consumption, more embedded functionalities (including AI capabilities) and at a lower cost.

-

Interoperability-by-design at component, semantic and application levels.

-

IoT configuration and orchestration management allowing for (semi)autonomous deployment and operation of large numbers of devices.

-

Decision support for AI, modelling and analytics, in the cloud but also in edge/fog settings.