3 ECS Key Application Areas

3.1

Mobility

Mobility is a basic human need and Europe’s mobility industry is a key contributor to it. The automotive sector alone provides employment, both direct and indirect, to 13.8 million Europeans, representing 6.1% of total EU employment. 2.6 million people work in the direct manufacturing of motor vehicles, representing 8.5% of EU employment in manufacturing1. The automotive sector is also the driver for innovation in many other mobility sectors in Europe, including aerospace, maritime and rail, but also in other sectors as e.g. farming and industry (advanced robotics).

The JRC Report “The future of road transport2” from April 2019 states: “Four key game changers are shaping the future of road transport: automation, connectivity, decarbonisation and sharing. These future technologies and services promise to contribute to fewer negative impacts from road transport while also generating new mobility paradigms and transport governance opportunities.”

This results in two major technological transformations for the mobility sector: the decarbonisation, which is the transition to a CO2-neutral mobility as contribution to the Green Deal, and the digitalization, which is in essence the introduction of significantly more automation in mobility to cope with societal challenges in an aging society without deviating from the vision of zero fatalities, as well as to provide mobility for a growing global population faced with scarce resources supported by environmentally optimal mobility modes and a CO2-neutral mobility.

Therefore, the ECS-SRIA mobility chapter part dealing with CO2 free mobility is aligned with the proposal for the partnership “Towards zero emission road transport” (2Zero) programme by Horizon Europe to achieve carbon-neutrality in road transport by 2050. Cooperation between 2Zero and the ECS community is important and well established.

This requires research in automated driving and ADAS advancing automotive safety, efficiency, and convenience. Relevant key focus areas include sensor fusion, control algorithms, computer vision, and real-time testing and verification. As the demand for ADAS and AD grows, understanding consumer preferences and addressing the technical challenges will be essential. Additionally, given the potential overlap between ADAS and fully autonomous vehicles, research efforts must align with broader industry trends and explore how existing technologies can pave the way for self-driving cars. Therefore, this mobility chapter is closely aligned with the activities of the partnership “Connected, Cooperative and Automated Mobility” (CCAM) under Horizon Europe.

These two major trends lead towards software defined vehicles, where customers replace horsepower by software functionality in their decision process for vehicles and mobility services (or modes). The Vision and Roadmap document3 of European Software-Defined Vehicle of the Future (SDVoF) initiative states: Software now drives value creation, serving functions and services both within vehicles (on-board) and in the cloud (off-board) as well as the infrastructure around the vehicle, which will provide mobility services. Customers prioritize “software freshness,” seeking new applications and services related to infotainment, connectivity, and ADAS/AD functionality. Regular over-the-air updates enhance cyber-security, safety, and innovation during the vehicle’s operational lifespan. This transition fuels demand for next-generation system-on-chip designs and high-performance processors, fundamentally reshaping software development and integration, and opens the opportunity to re-think and re-design the vehicle software stack to match the need of the vehicle of the future.

Regaining European sovereignty in semiconductors for mobility is one important goal in these transitions. The other one is to avoid disconnection between cities with abundant infrastructure and less developed regions with lack of understanding for new technologies, but need for basic mobility and services. Europe is ranked number one in automotive semiconductors. In the automotive value chain, Tier 1’s and original equipment manufacturers (OEMs) are also top global players and intend to gain further market share through close collaboration with semiconductor and embedded software leaders in Europe.

In general, the ECS community needs to think also politically and take into account the fact that some parts of the population feel lost in all these transitions. Step back, slow down, analyse what might help immediately, do development works in the regions rather than in cities.

Make sure that developments are not only done for initial prototyping and further departure to Asia.

The electronics components and systems (ECS) community will contribute substantially to these tasks by using new technologies, components and systems to target the following topics:

-

Electrification of vehicles and development of powertrains for carbon-free energy carriers. Enabling technologies are coming from the European ECS industry – for instance, energy-efficient devices, power electronic components and systems, energy (e.g. battery) management systems, and embedded software solutions for power management. Furthermore, integration into the grid to enable better contribution to the energy transition with bidirectional energy flow. Strengthening of infrastructure to increase confidence into electric mobility and exploitation of opportunities to demonstrate cost advantages of EV compared to ICE cars. Strengthen European technologies through fostering collaboration between actors in vertical value chains.

-

Automated and autonomous vehicles and coordinated mobility to make traffic more efficient and thus reduce pollution by new electronics architectures, smart and connected sensor systems, AI-based real-time software, higher performance in-vehicle controllers and networks, as well as connectivity devices and advanced embedded software solutions. Implementation of mobility services to close gaps for users in regions with limited mobility infrastructure.

-

Rapid advances in AI and edge computing will ensure Europe can produce a step change in these areas. Automated and autonomous driving, mobility and logistics are complex applications where the use of AI technologies is growing very rapidly, affecting both society and industry directly. The European transport industry is being revolutionised by the introduction of AI (combined with electric vehicles). However, AI applications in transport are very challenging, as they typically have to operate in highly complex environments, a large number of possible situations and real-time, safety- relevant decision-making. Leading IT companies in the US and China in particular are providing a challenge to European industry in these areas, and significant effort will be required to safeguard the leading position of the European automotive industry. Hence the development of high-definition digital maps, digital twins is a crucial element to further develop and update all types of vehicles interacting with and within the environment, with each other and with the cloud. It must be accompanied by evolutionary tools and processes that allow employees to learn, adapt and evolve into new assignments and tasks.

-

There will be a need to more intensively monitor, interact with, and update the car remotely. Remote supervision and operation as well as software upgrades need to be done over-the-air (OTA) via high-speed connectivity. Semiconductors have a shorter lifetime than cars and hence it is needed to predict their end-of-life and to replace them on-time before the car breaks down.

Mobility products are used by people/citizens, everywhere and every time. It means that it has impact, that has to be approached with different perspectives:

-

Human: equity, inclusivity, health

-

Safety, (cyber)security

-

Accessibility (incl. affordability)

-

Environment

Each perspective is a powerful innovation driver, requiring ECS novel solutions such as

-

Human: driving under influence (drugs, alcohol…), emergency calls, devices for disabled people, health monitoring…

-

Safety: child presence detection, Vulnerable Road Users…

-

Affordability: ECS guidelines to achieve affordable cars?

-

Environment: eco-design, circularity …

This impact also leads to new regulations and policies on EC or national level which need to be considered already at very early stages.

The global automotive industry is already undergoing this transformative shift due to software-defined vehicle (SDV) concepts and over-the-air (OTA) updates. SDVs separate hardware from software, allowing for dynamic updates and upgrades. The vehicle becomes a command center, collecting and organizing vast data volumes, applying AI insights, and automating actions. This architecture transformation simplifies integration and supports service-based business models. Meanwhile, OTA updates enable vehicles to add new features, enhance performance, and address issues without physical visits to service centers. Consumers experience progressively improves during vehicle ownership. Customized enhancements and safety feature updates create a closer relationship between original equipment manufacturers (OEMs) and end-users, opening also new opportunities to developers. As a result, the automotive landscape is becoming more connected, adaptable, and user-centric, with significant implications for business models.

The emerging mobility applications in SDV typically comprise both hardware (HW) and software (SW) components within the vehicle, as well as additional components hosted in the cloud leading to edge-to-cloud (edge2cloud) applications. These cloud-based elements rely on data from various industry sectors demanding a coordinated approach in their respective development roadmaps. For instance, optimised charging applications guide electric vehicles to available and fast charging stations along their routes. These applications rely on real-time information about vehicles battery status and the charging station status, the integration with wireless billing systems, and -in the case of bidirectional charging - close ties to energy providers. Other examples include automatic toll collection systems, parking and depot applications, and traffic control systems that provide correct road condition information (including hazards like black ice) based on data shared by other vehicles, weather authorities and traffic/transport infrastructure. The complexity of these edge2cloud applications increases significantly due to the need for coordinated development across diverse industry domains.

In addition, the European automotive industry faces intensified global competition due to non-EU manufacturers’ early adoption of software-driven strategies. Large tech companies and hyper-scalers leveraging substantial software budgets and indirect business models, are already dominating specific domains. Additionally, significant state aid in East Asia facilitates rapid market entry for new companies.

Key is an user-oriented innovation: the major competitiveness driver for an application industry such as automotive is to quickly introduce user-oriented innovations, i.e., innovations that bring maximum “visible” value to the customer. It means that the main challenge is to integrate the best ECS technologies into innovative use-cases. Electronics- and software-based systems provide important key enabling technologies for these transformations. Sensors, semiconductors and embedded AI enabled software in integrated intelligent systems are essential building blocks. Nevertheless, energy and cost efficiency in the operation of transport systems as well as in the development and production of mobility systems as vehicles, ships, trains, airplanes, remain important RDI tasks.

Therefore, the research scope encompasses the development of energy efficient mobility grade semiconductor, sensors, actuators, AI enabled HW platforms as well as embedded AI enabled software platforms and edge2cloud software for all mobility modes. Automotive mobility includes systems for passengers and goods (passenger cars, two/three wheelers, trucks), mobility in smart farming with specialized farming machinery, ships and vessels in maritime mobility as well as mobility in the air (for passengers and goods) using airplanes, helicopters or UAVs (Unmanned Aerial Vehicles) (drones), and last but not least mobility on rails provided by trains.

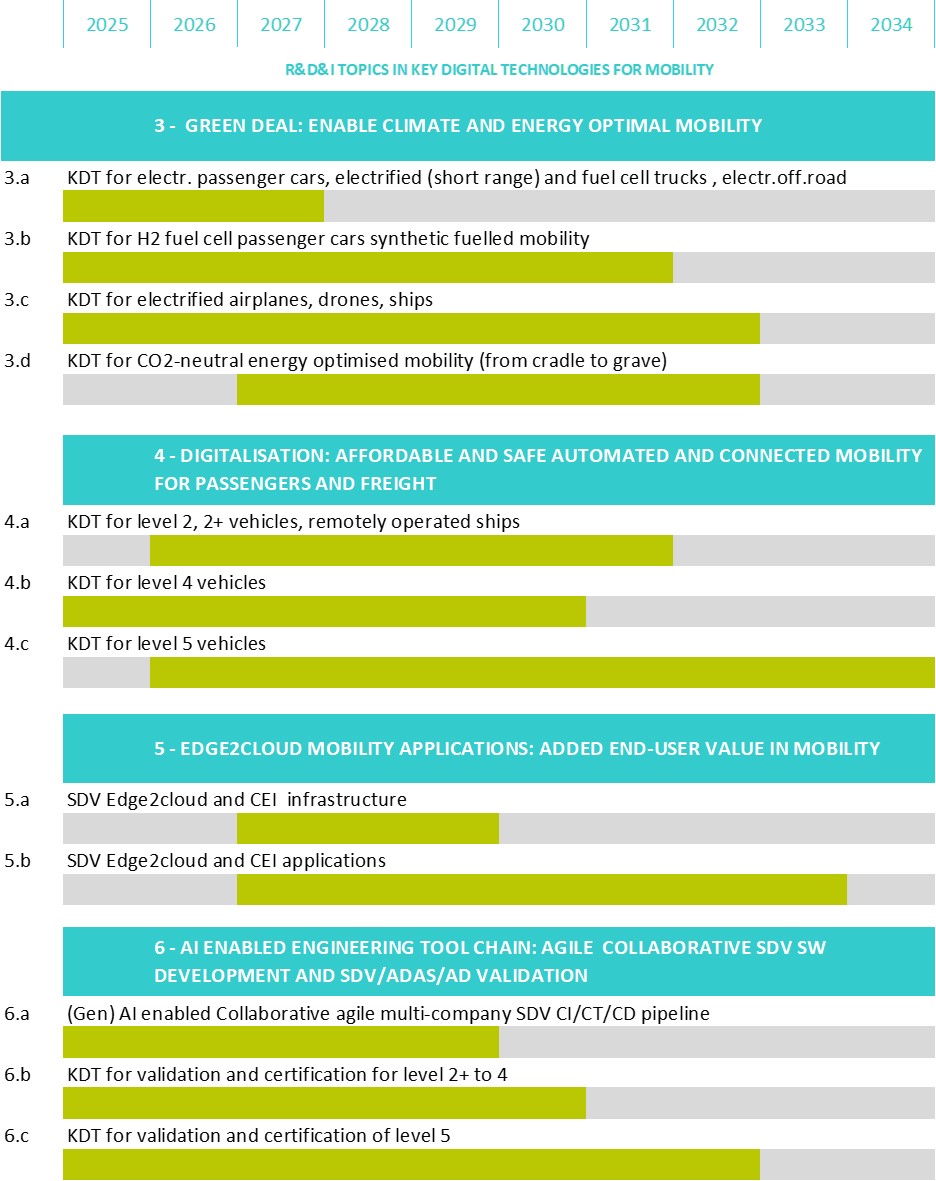

The changes in mobility explained above lead to following six main ECS RDI challenges for mobility:

-

Major challenge 1: SDV hardware platforms: modular, scalable, flexible, safe & secure

-

Major challenge 2: SW platforms for SDV of the future: modular, scalable, re-usable, flexible, safe & secure, supporting edge2cloud applications

-

Major challenge 3: Green deal: enable climate and energy optimal mobility

-

Major challenge 4: Digitalisation: affordable and safe automated and connected mobility for passengers and freight

-

Major challenge 5: Edge2cloud mobility applications: added end-user value in mobility

-

Major challenge 6: AI enabled engineering tool chain: agile collaborative SDV SW development and SDV as well as ADAS/AD validation

Mobility ECS systems consist of Hardware, Software and AI, the challenges are covering them as summarized below.

The mobility ECS system hardware comprises:

-

Computing hardware as enabler for SW and SDV platforms – see challenge 1

-

Hardware components for electric energy (power) and actuation – see challenge 3

-

Hardware components for sensing and perception – see challenge 4

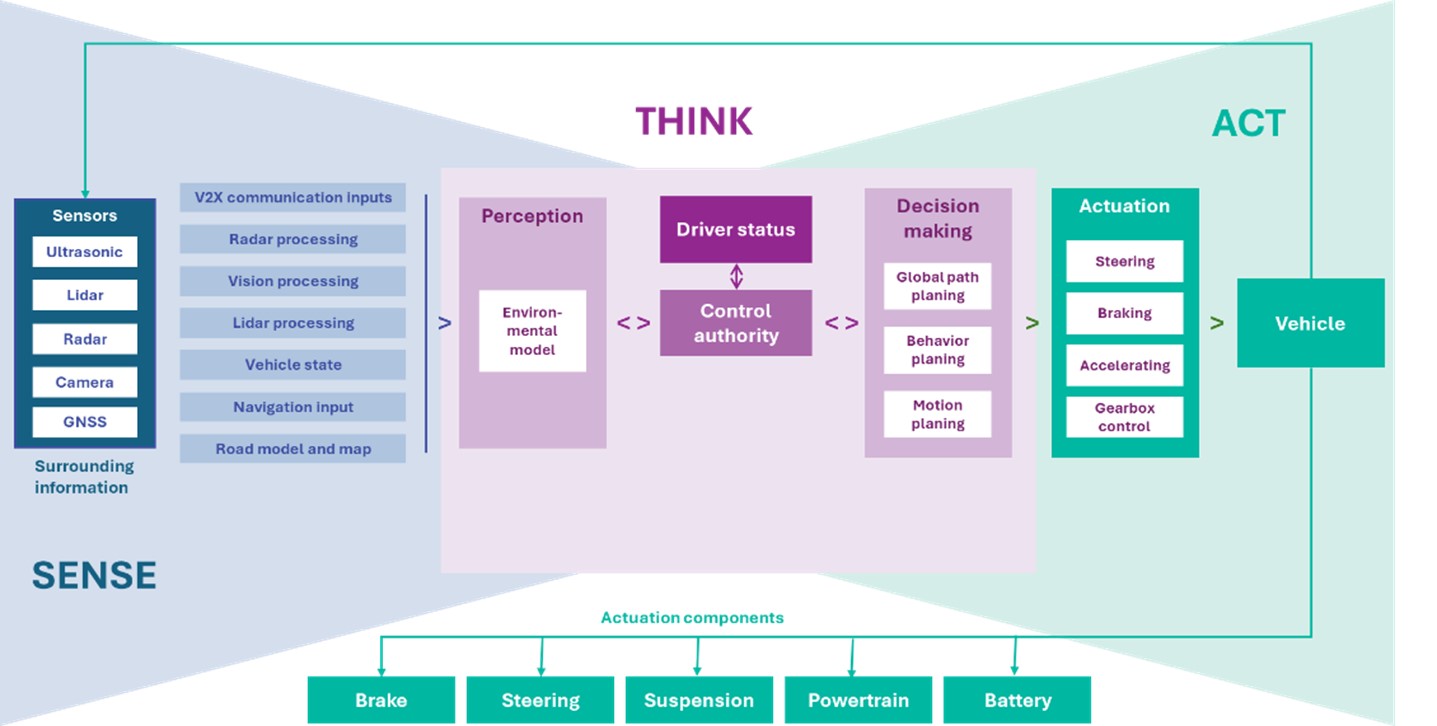

The mobility ECS system software uses information from sensing and connectivity to actuate and to manage data and interact with the driver and passengers of a vehicle (this includes the increasingly important infotainment and cockpit) – see challenge 2

AI is applied to the vehicle to improve performance, user experience, safety, etc. (see challenges 1, 2, 5) as well as applied to tooling to improve engineering & manufacturing processes (see challenge 6)

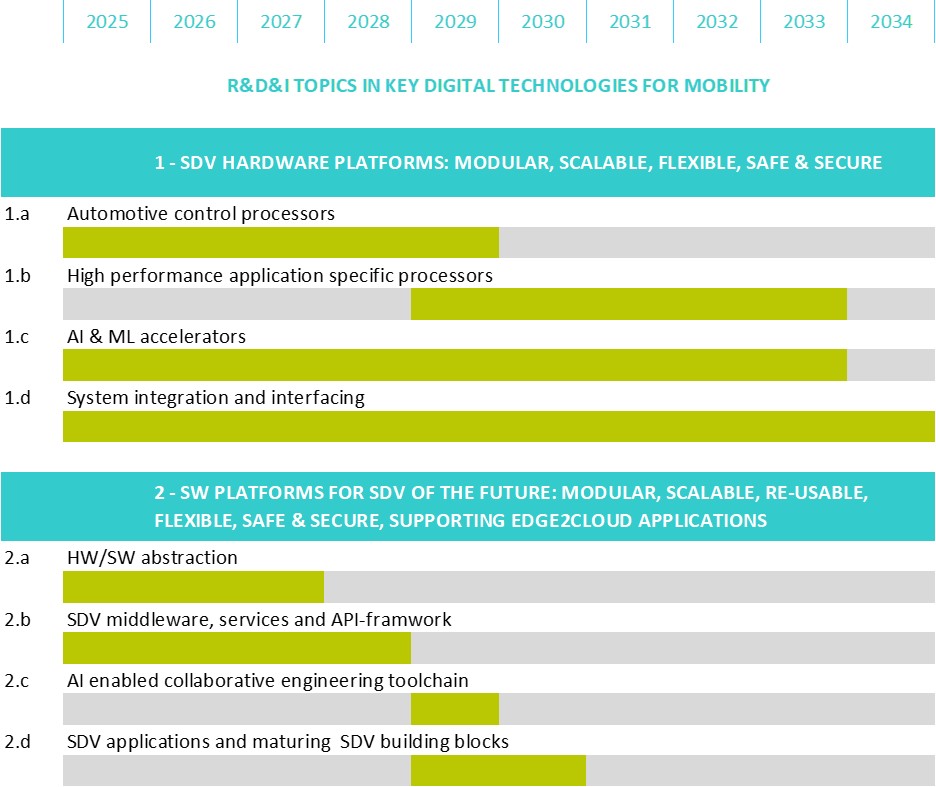

3.1.4.1 Major Challenge 1: SDV hardware platforms: modular, scalable, flexible, safe & secure

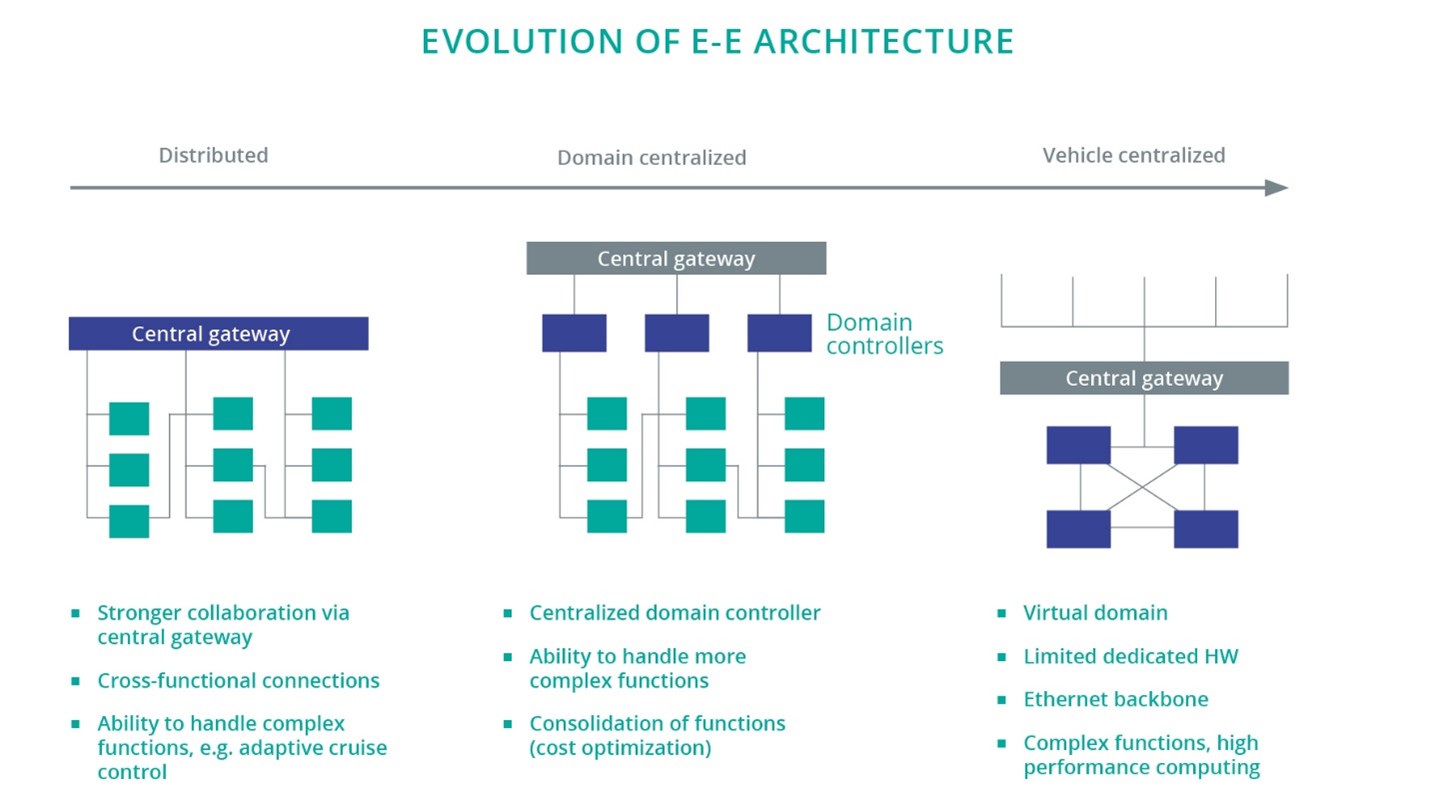

The automotive industry has traditionally been accustomed to a multitude of interconnected Electronic Control Units (ECUs), each with their own specific function, architecture, software stacks and operating systems. As more functionalities and safety features were incorporated into the vehicle, some organisation of ECUs has taken place, and different units communicate via a centralised gateway. With the evolution of the car and the functions now expected from the end-costumer, such as better infotainment services and autonomy, this model is becoming increasingly untenable. The presently prevalent decentralised architectures have significant drawbacks when it comes to scalability and communications performance.

The current trend is such that an increasing number of functionalities are software defined. In fact, it is projected that the number of lines of code per vehicle will go up from the current 100 million to 1 billion by 2030. From a hardware perspective, the increased autonomy being incorporated in the automotive sector causes that on-board computing is centralised, otherwise it would be untenable to network the increasingly interdependent ECUs together due to latency and the scale of the wiring harness, amongst other limitations.

The solution to these issues is the centralisation of the E/E architecture whereby several ECUs are consolidated into so called Domain Control Units (DCUs) or Zonal Control Units (ZCUs) that integrate different functions into a more cost-effective solution. It is foreseen that eventually these DCUs/ZCUs will be networked to a centralised SoC that integrates and combines the different functions such as autonomous driving, infotainment and cabin control.

With this in mind, the RISC-V Automotive Hardware Platform initiative is designed to consolidate and strengthen Europe's leadership position in the automotive electronics sector. This initiative comes at a critical time as the automotive industry faces fundamental shifts with the centralisation of electrical/electronic (E/E) architecture in vehicles and the advent of more electrified, automated, connected, and ultimately shared modes of transportation.

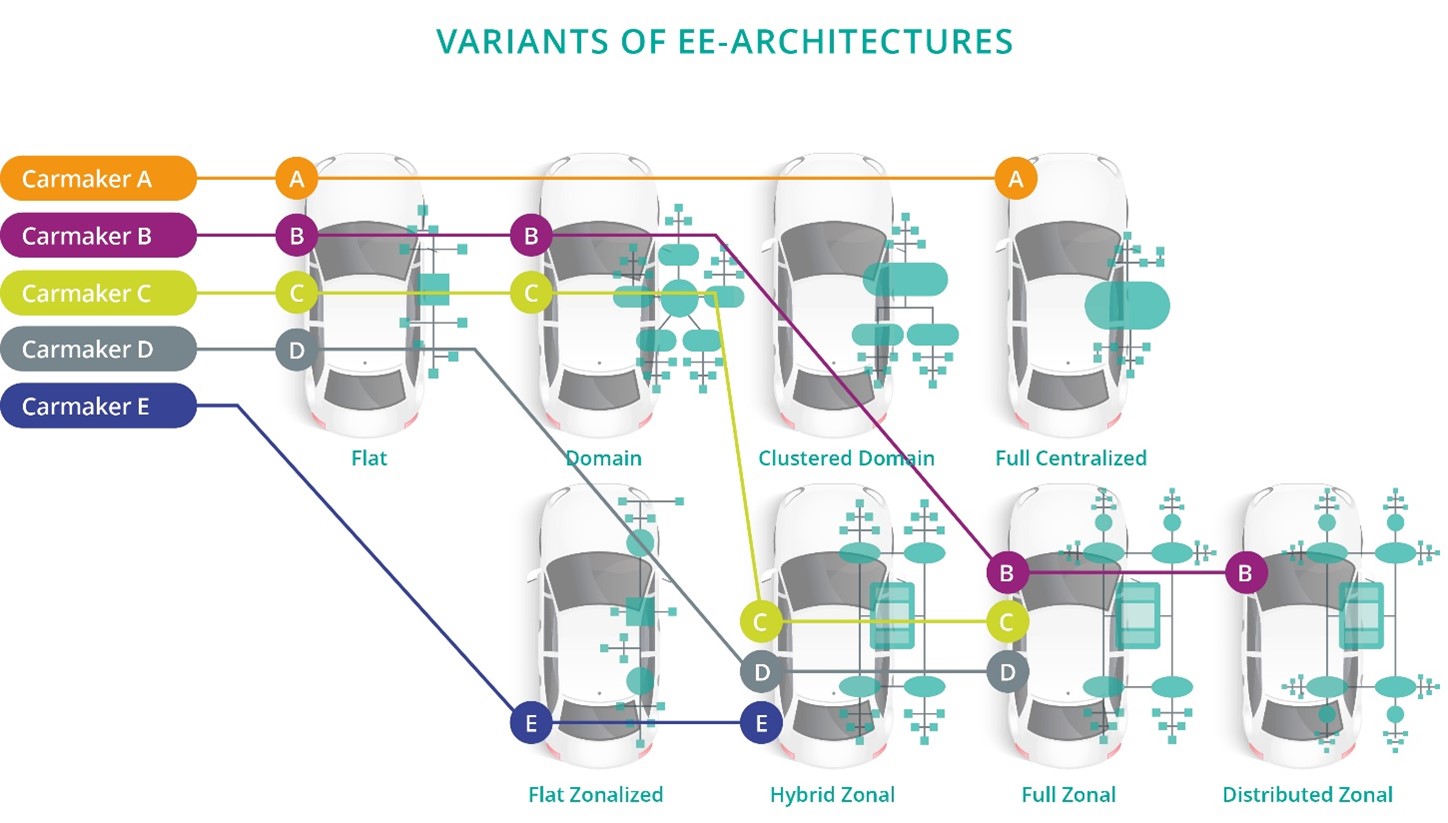

Furthermore, it is expected that there will be no one vehicle architecture, but that there will be different flavours, based on the type of OEM and/or based on the type of car (low-end versus high-end), as depicted in the picture below.

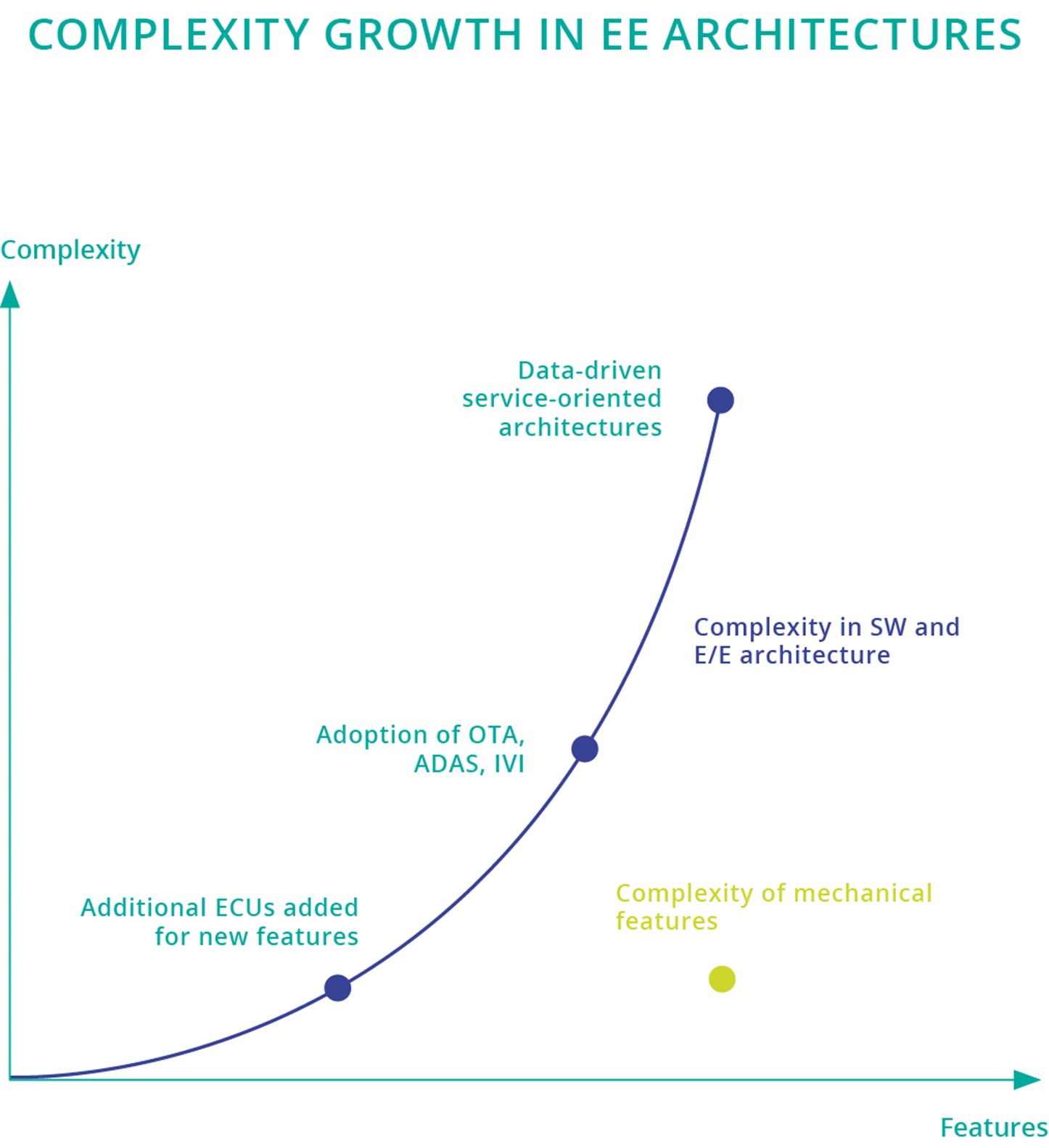

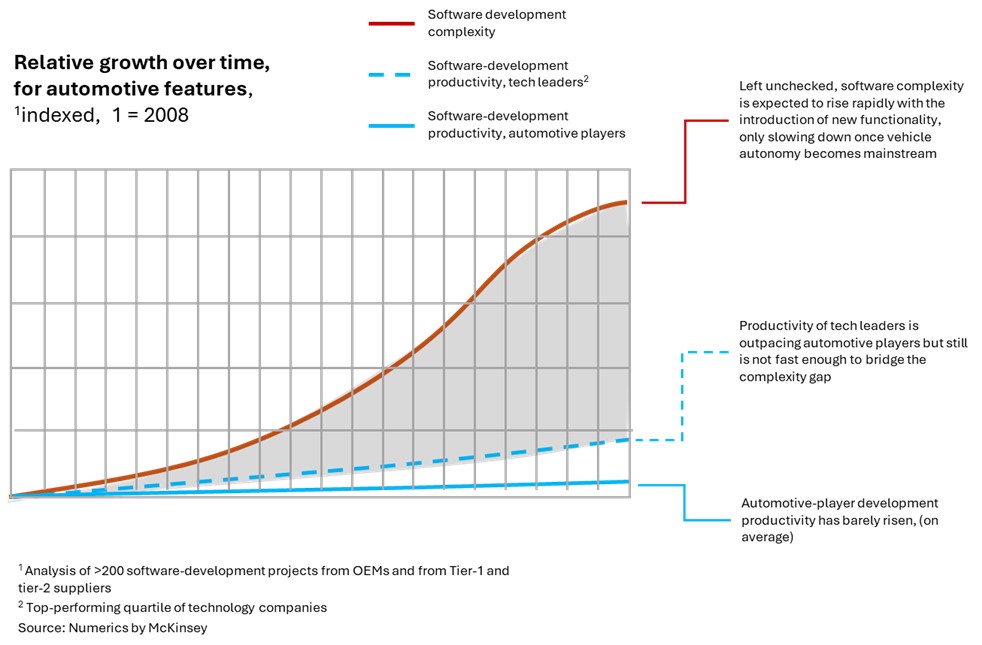

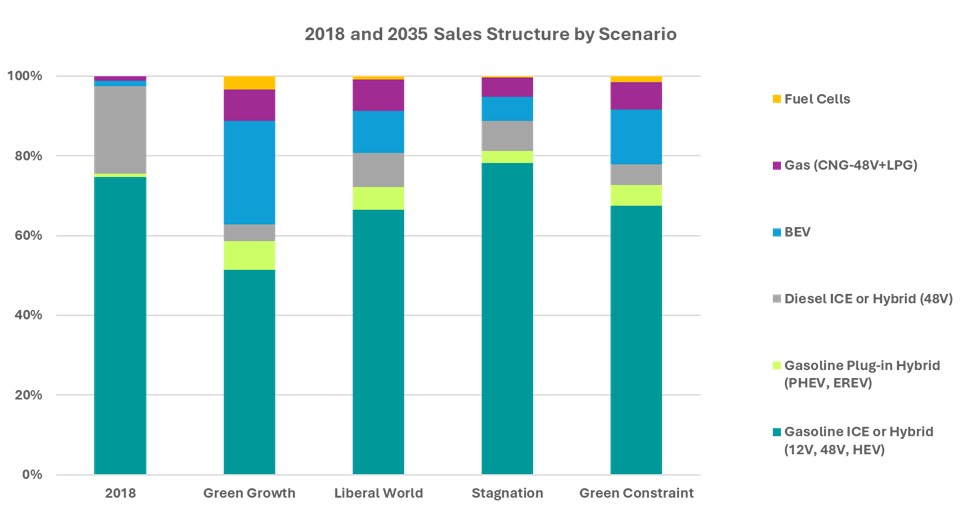

In addition, the growing complexity in both automotive software as EE architectures (- as qualitatively shown in the picture below -) requires new families of high-end control units and application-specific processors with a large number of system integration challenges.

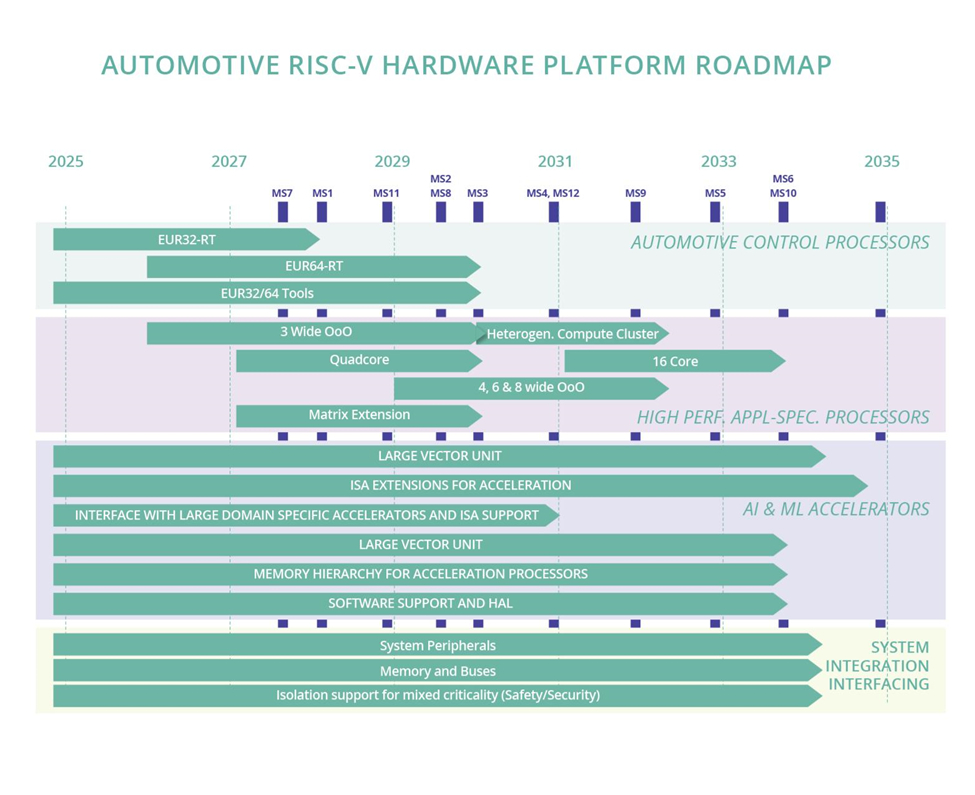

To address this ongoing transition and challenge, a high-level roadmap, based on the RISC-V instruction set architecture (ISA), has been developed for designing future automotive reference platforms, such that all involved stakeholders can use the flexibility provided by the open-source ISA. Through the reference platform approach proposed by this roadmap, European industry will have a springboard for further innovation in automotive electronics.

A high-level view of the roadmap as is explained in more detail in the document4, is given below. The roadmap has been split into 4 key elements or categories of the overall RISC-V based processors:

-

Scalable RISC-V Automotive Control Processors.

-

High-Performance RISC-V based Application Processors.

-

AI and ML Accelerators.

-

System integration and interfacing.

-

Fiber optics networks in cars.

-

Wireless communication in cars incl. plug and play SW.

The four elements are linked to each other. The first contains automotive-specific real-time control processors. They are the starting point for the second category, which is more generic and applicable for other type of application domains (communications, industrial, health, etc.). One example is industrial robotics – for advanced motion control, computer vision, inspection, and health and safety applications – and drones/UAVs, where a series of grand challenges is emerging including sensor fusion and processing for detect and avoid applications in a low-cost, low-weight, low-power form factor. The third category contains accelerator elements which are specific developments for both automotive as well as other domains, and which contains starting points for next generation processors. As these accelerators are a key component of both processor families, we have opted to make a separate category to show the different IP elements to develop in the coming years. The fourth category contains specific elements for system integration, more in particular how controllers and processors fit into global system solutions.

The elements can be considered as linked activities as part of a reference platform. By definition, this includes the computational elements along with the supporting infrastructure required to realise the whole platform. Therefore, the reference platform infrastructure roadmap laid out includes both SoC and chiplets interconnects.

Along with the core (CPU) clusters, three key components are needed to sustain the high memory bandwidth needed by the processor, as well as controllability features towards supporting, to a sufficient extent, freedom from interference across real-time applications with integrity requirements. Those components are the following: (1) Shared cache memories capable of supporting a large number of outstanding requests from a high number of out-of-order cores, both in terms of (data) bandwidth as well as in terms of managing pending requests minimizing serialization, (2) High-bandwidth interconnects with Quality of Service (QoS) minimizing contention and allowing some control on the traffic priorities through the deployment of programmable QoS support, And (3) high-bandwidth memory controllers with QoS support able to manage out-of-order requests, minimizing serialization, and allowing some controllability on the traffic priorities.

Another important HW-challenge is the introduction of “automotive chiplets, which will be used in System on Chips designed considering the mobility application industry perspective and pooling for smart packaging solutions at early stage of development:

-

SoC design to achieve the best trade-off between performance, integration ability and system affordability

-

Explore architectures mixing advanced cutting-edge technologies as well as on-the-shelf mature solutions

-

Identify key bottlenecks to be overcome

-

Investigate micro-architecture solutions and set-up the playground for a fair and relevant split between “open-source” and “proprietary” zones

The development of these chiplets is part of the automotive RISC-V platform roadmap.

3.1.4.2 Major Challenge 2: SW platforms for SDV of the future: modular, scalable, re-usable, flexible, safe & secure, supporting edge2cloud applications

As the automotive industry moves towards autonomous, electric, connected, and service-oriented vehicles, hardware and software are becoming increasingly important in managing their operations and enabling new features. “Software-defined vehicles” are getting more valuable than traditional vehicles based mainly on mechanical parts, with electronics and software playing a key role in this new paradigm. Customers value new software applications such as infotainment, connectivity, ADAS/AD functionality, and regular over-the-air updates for new or improved functionality during the operational phase of the vehicles, automatically or on-demand. New apps are also combining cloud with vehicle functionalities to increase the comfort and safety of the driver for day-to-day operations such as charging, parking, and driving. Customers are already willing now to switch brands for these better applications and features.

These updates of the vehicle software over the lifetime of the vehicle results in a radical change of business models in the automotive industry. Hardware and software of vehicles are getting different lifecycles. The electrical and mechanical parts of vehicles are mostly fixed at the time when a customer buys a vehicle ( - in rare cases also for HW parts replacements may be offered - ), but the software continues to change, adapt and improve over the operational phase of the vehicle as long as the customer accepts software updates. The over-the-air software updates imply a significant increase in the value of a vehicle for customers. But it also requires a dedicated SW/HW abstraction in software defined vehicles.

A software platform, which includes virtualization, operating systems, middleware, and an API framework, also supporting the integration with the cloud in edge2cloud applications, plays a key role in this new paradigm of SDV. By raising attention to software and hardware, manufacturers can create more value for their customers and stay ahead of the competition. Embedded computing hardware and software are therefore have become extremely important for the OEMs.

Consequently, electronic architectures of vehicles are becoming more centralized, fuelling the demand for next-generation system-on-chip designs and high-performance processors, and redefining how software is designed, integrated, and maintained (see major challenge 1 in chapter 3.1.2.1). The software layers between hardware and applications, including interfacing with the cloud, play a key role in this paradigm shift.

Automotive players must transform themselves into software-defined companies, but they are facing difficulties with software development. Software complexity is rising sharply. Increased complexity of functionalities and sharing of computing resources across electronic control units, vehicle domains, and the mobility and cloud infrastructures reduces the software development productivity (see Figure 3.1‑5). Because of the rapid transformation to software-defined vehicles (driven by new vehicle functions, features, properties), the automotive industry is facing a widening and unsustainable gap between software complexity and productivity.

Many non-compatible SW platforms (often coming from suppliers) used at different OEMs (and often even within one OEM) create big redundant and non-value adding effort in development and even more in maintenance. This leads to delays and cost overruns for software projects.

Additionally, the industry is facing a major software talent shortage.

To succeed in this dynamically changing environment and to be globally competitive, companies need to minimise (or at least limit) the complexity by reducing the effort required to develop and maintain software. Consequently, the current software operating model needs to be revisited in terms of:

-

Architecture, design, requirements.

-

Development methodologies (e.g. agile-at-scale, or fundamental changes in development and software testing).

-

Software performance management, toolchain infrastructure.

-

Location and organizational unit where the software is developed, including involved partnerships.

-

An end-to-end software platform (consisting of virtualisation, operating system and a middleware and API-framework layer with standardised interfaces) abstracts the hardware layer for the application. The function software layer shall be supported in managing the rising software complexity and developing future vehicles in an effective and efficient manner. Software should be truly integrated end to end, software modules should be developed on a common code base, and a primary robust operating system should be able to cover all major systems throughout the vehicle families.

So far, car companies have focused on developing proprietary technology platforms, impeding efficiencies when such investments replicate efforts on elements that are not differentiating and visible to the customer. A rising number of partnerships and alliances across varying types of actors of the automotive and digital ecosystems shows a growing openness to join forces. They however do not cover systematically all the non-differentiating elements of the software stack and lack in many cases sufficient implementation. They receive help from stronger cross-initiative coordination and governance.

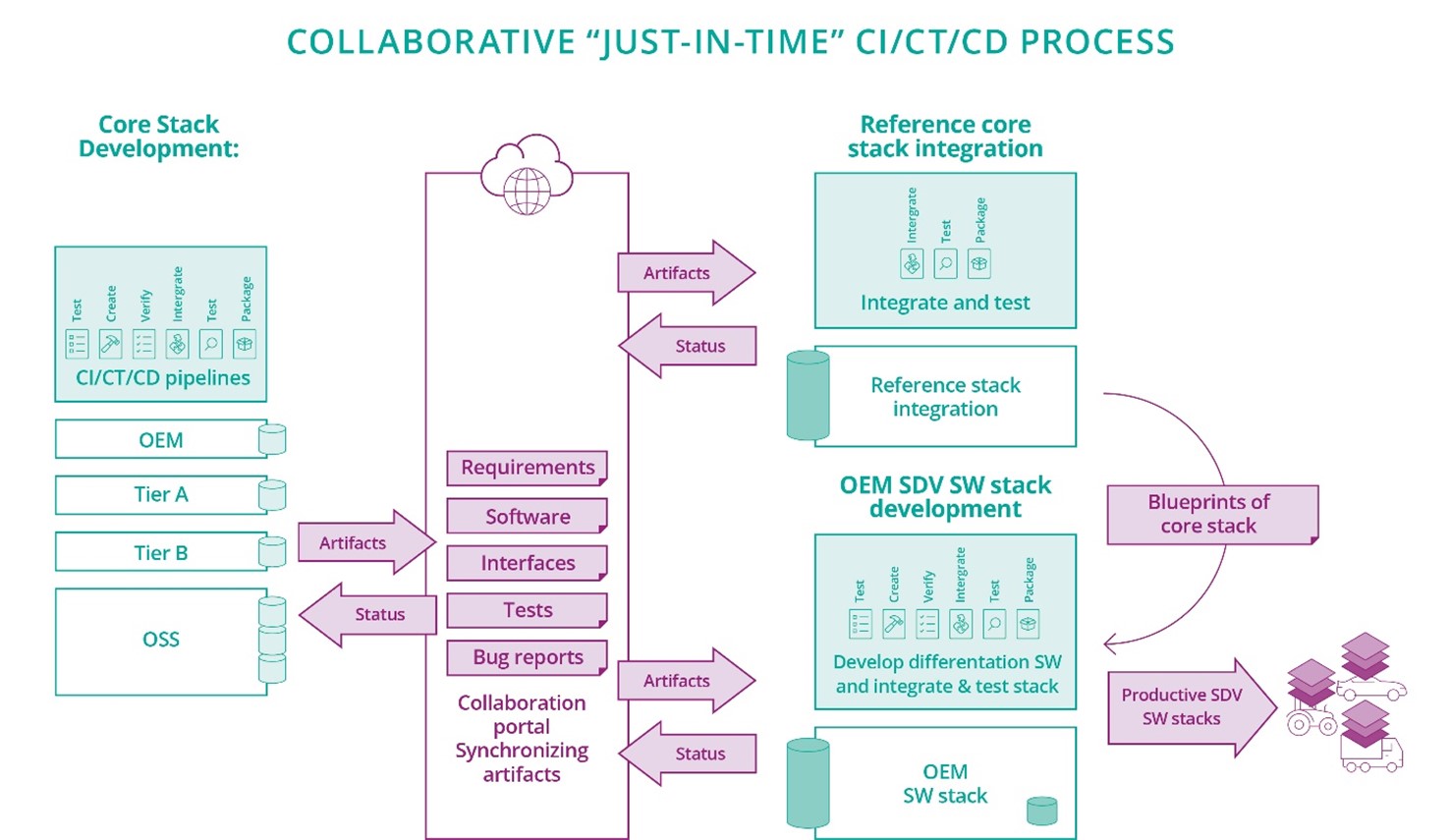

In this context, the European automotive, embedded SW and semiconductor industry together with the European Commission have started complementary but distinct industry driven initiatives to reinforce EU strategic autonomy and leadership in the automotive value chain on the vehicle of the future (SDVoF). It addresses the need for an open automotive hardware platform and an open SDVoF ecosystem driven by European actors. The open SDVoF initiative focuses on an open and pre-competitive collaboration driven by European OEMs and suppliers on non-differentiating elements of the vehicle software stack. The initiative aims to reinforce the coordination between existing alliances by orchestrating distributed developments and ensuring close links with EU and global initiatives on an open automotive hardware and software platform. Stronger cross-initiative coordination and governance create benefits to existing partnerships and alliances working on these technologies.

The creation of an European SDV ecosystem is essential with the objective of developing application-oriented, open-source building blocks and to promote EU start-ups and SMEs introducing relevant mobility applications thanks to a shared toolchain. Agility and development speed are crucial challenges in this endeavor. It is mandatory to reuse existing proven building blocks and design patterns wherever possible. Cooperation with well accepted initiatives in the automotive industry working on various aspects of the SDV are essential to avoid duplication of effort and to reduce the time-to-market. Several initiatives and alliances working on an automotive SDV platform (e,.g. AUTOSAR5, Catena-X6, COVESA7, Eclipse SDV8, FEDERATE9, SOAFEE10, 2Zero11, CCAM12).

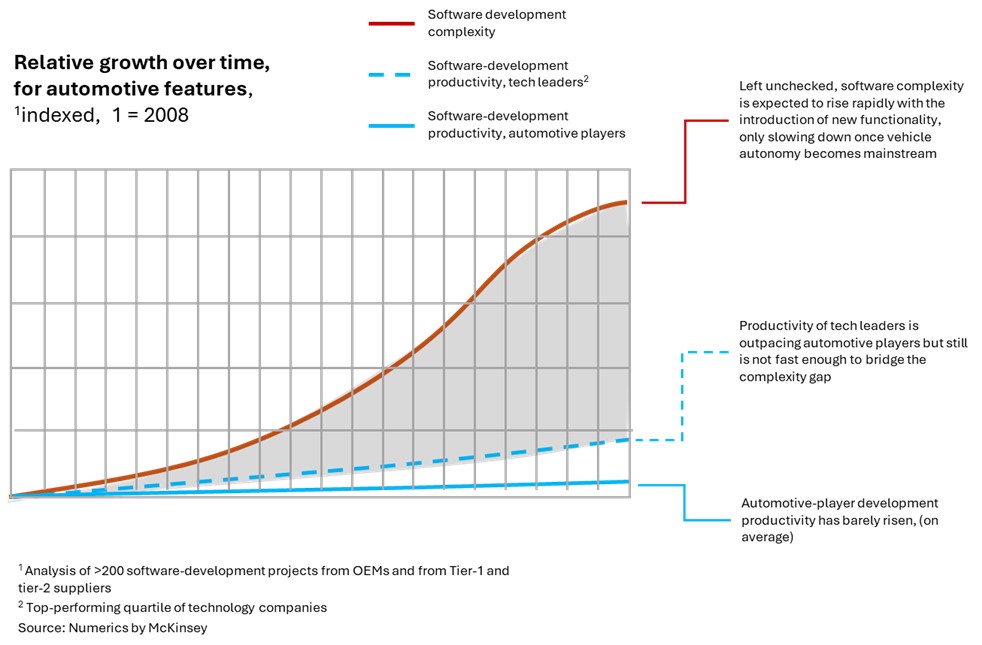

The initiative has agreed on a three-layer structure for SDVoF HW/SW stacks as depicted in Figure 3.1‑6. The initiative aims to develop collaboratively non-differentiating building blocks in the “Middleware and API framework” and “Car meta operating system & HW abstraction” layers with implementations in-vehicle as well as off-board in the cloud. Wherever useful and possible, open-source shall help to gain agility as well as a selection of the best SW technologies and/or solutions. The building blocks will be used in existing or new SW stacks of OEMs or tiers, which will bring the new functionalities into vehicles on the road. Experts from the European automotive industry organized several workshops to create a layered model (see Figure 1) of SDV SW stacks as shown in Figure 3.1‑6.

The SDV structure abstracts the HW resources as processor resources, sensors, actuators, data coming from various communication media as well as data in the cloud (e.g. about traffic status) and the services build upon them for the application software used by vehicles, its drivers and passengers. This shall increase development efficiency and agility for user-relevant software applications. The SDVoF HW/SW-stack consists of the following layers:

-

Layer 1 (SDV-Hardware): This layer includes all hardware components as automotive High-Performance Compute-platforms (HPC) and domain controllers and the SW abstraction of resources of the HPCs and domain controllers required for the largely AI-based software, serving several automotive domains with applications satisfying requirements like non-safety critical, safety critical, security, energy efficiency, etc.

-

Layer 2 (SDV-middleware & hardware abstraction & OS): This software Layer 2 is the major focus of the SDVoF initiative. It consists of (mainly open-source and mostly non-differentiating as well as some closed source and/or differentiating) software building blocks, which connect the hardware layer with the applications layer to allow separated hardware and software development cycles necessary for software-defined vehicles of the future. This layer also ensures the safe execution of the applications of layer 3. It shall consist of software building blocks, which can be used also in existing OEM specific SW stacks. As many applications have on-board and off-board (cloud) parts, a service-oriented interface layer shall also exist in the cloud.

-

Layer 3 (SDV-Applications): This layer contains the differentiating parts with applications in automotive domains such as infotainment, automated driving, advanced driver assistance functions, chassis and powertrain control, cockpit user interfaces, e-charging, routing, body-and comfort functions, etc. Many of these applications have parts on-board the vehicle and other parts off-board in the cloud.

To ensure agility, non-differentiating modular software building blocks shall be developed, which allow to build SDV software platforms or enhance existing company-specific SDV software stacks. A consensual definition of interfaces for these non-differentiating building blocks is highly important. The integration into the company (OEM or Tier) specific software stacks may require adding thin layers of company-specific software (“glue logic”) to cope with the differences in the existing as well as future company-specific architectures. As the focus of the building blocks is in the non-differentiating area, they will reside in mainly layer 2, which consists of essential functionalities as virtualization, car (meta) operating system, HW/SW abstraction, the on-board middleware, API framework and cloud middleware.

Many of these software building blocks will be open-source in order to allow a resource sharing in the development of non-differentiating parts of these essential SDV SW platforms. The essential agility and speed in the development of these highly complex SDV software systems shall be achieved by applying the “code-first” principles. The “Code-first” approach has several goals: firstly, iterative development to sequentially improve building blocks and integrate them as soon as possible into industrial SW stacks. Standardization effort will only start, when building blocks have proven their functionality, robustness, and quality in real-world usage. Secondly, test driven development is a very good development methodology of an agile “Code-first” approach. It basically means, that the test procedures are designed and already implemented as part of the requirement specification. This also helps to significantly improve the quality of requirements and then of the code. Additionally, it supports the automation of testing.

Key RDI topics

-

Development of a scalable, cloud-capable, and modular target architecture that supports decoupling of hardware and software and features a strong middleware layer consisting of building blocks. The building blocks of the SW platform needs to support current and future E/E architectures (domain-oriented, zone-oriented etc.). Most of the building blocks are expected under an open-source license in one of the participating initiatives.

-

Development of a neutral SDK (software development kit) which allows software application developer to develop and test independently of hardware and operating system.

-

Abstraction of the complexity of underlying hardware, middleware, kernel, interfaces, and drivers into simple to use and to re-use, robust, safe & secure APIs.

-

Supporting and ensuring safety and security requirements using automotive standards for significant parts of the SDV (refer also to the SRIA chapter 2.4 MJ 3).

A high-level view of a roadmap is explained in more detail in the document13 created and updated by the CSA Federate and shown in the diagram below. It will be continuously aligned with relevant initiatives in the European commission as well as with industry initiatives mentioned above.

3.1.4.3 Major Challenge 3: Green deal: enable climate and energy optimised mobility

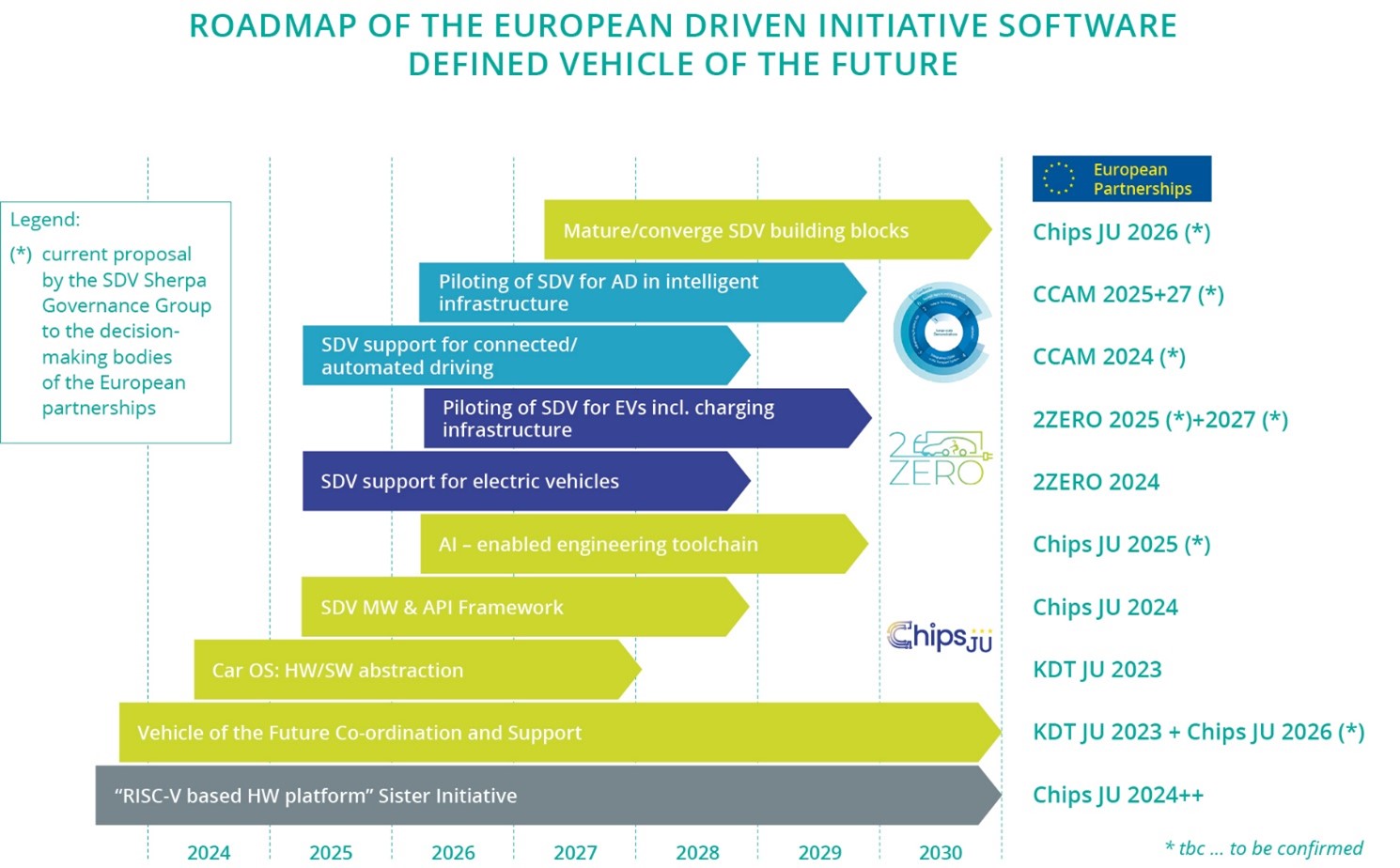

Worldwide efforts on the regulation of pollution and CO2 emissions are leading to a strong increase in the electrification of vehicles, either with batteries (“battery electric vehicles”, BEVs), vehicles with internal combustion engine and electrical engine (“hybrid electric vehicles”, HEVs) or vehicles using fuel cells. Possible scenarios developed by BIPE14 in France are shown in Figure 3.1‑8. Depending on the evolution of regulations in particular, the split between the various energy sources could be significantly different between the scenarios in Figure 3.1‑8. However, the most probable scenario is that of the “Green Constraint”. But currently there are discussions about bans of fossil fuel engines even as soon as 2035, therefore the data are expected to change.

Looking in more detail at the difference between low voltage systems (particularly 48V) and high voltage systems, there are six important observations that can be made:

-

All new cars in Europe will be electrified by 2035.

-

The proportion of electrified cars in the world will reach about 70% in sales.

-

Around one-third of the market will require on-board chargers for high voltage in the range 400–1000V.

-

Fuel cell electric vehicles may play a significant role in long-haul trucks and trains, as well as in airplanes, ships, and drones by 2035.

Convergence of automotive and energy eco-system

Electrified cars are becoming an integral part of the European energy eco-system. Vehicle batteries will be used as intermediate storage for electrical energy (bidirectional charging). Vehicles will even produce electrical energy (photovoltaic panels on car roofs or from heat-pumps), which will be partially send to the grid. This has severe consequences for the requirements of the electrical and software systems in the vehicles. Their operation hours over the intended lifetime of the vehicle are significantly increasing. Up to now, the lifetime for the components of vehicles is about 8000 h, which reflects the hours a typical vehicle is driving. As the vehicle will soon become an integral part of the grid, its total number of operating hours will be the total number of hours per year (both running and connected-to-the-grid time) multiplied by the expected lifetime of the vehicle in years. This means an increase of lifetime of the effected components (as in the bi-directional charging or the necessary embedded control software) by a factor of 5 to 15. This convergence of the automotive and energy eco-system creates also large challenges in the validation. It requires significant use of digital twins in the simulation.

The expectation is that the overall electrification scenario will lead to massive changes in the supply chains and the distribution of competences. An important aspect in the CO2 reduction is the speed of reduction. Selling new cars with best performance characteristics will only show an effect in the medium and long term. Any solution that improves the existing parc of 250 million cars in the world would have a much higher impact.

Car sharing, more efficient tires, teleworking and better lubrication can also add-up to significant and instantaneous CO2 reductions. In this respect, the electronics industry should regard solutions that support rapid deployment of CO2 reduction initiatives.

Key RDI topics

-

Modular, flexible, and scalable platforms and electrical/electronic (E/E) architectures.

-

Hardware upgradability and packaging that supports repair

-

Exchange of existing components and systems by higher efficient modules.

-

Reconfigurable and adaptable software architectures.

-

Software updateability (including over-the-air, OTA).

-

On-board technologies (devices, actuators and sensors, virtual sensors).

-

Embedded intelligence (AI-powered and AI-enabled intelligence):

-

Control software, real-time capable algorithms.

-

Fault-tolerance, fail-operational concepts.

-

Cognitive vision.

-

-

New control software is required to take full advantage of new solid-state batteries so that they have an extended lifetime, as well as a higher driving range in vehicles. Other trends are SIBs and high silicon content. As lifetime is key for batteries used in mobility systems, tools for accelerated lifetime testing, diagnostic systems as well as control systems that can extend the lifetime and limit degradation, are essential for the success of electrified green mobility. New power electronics based on silicon carbide (SiC) and gallium nitride (GaN) devices are needed to ensure energy-efficient operation. AI and model-predictive control algorithms, supported by high-performance, multi-core, real-time operating systems, has to offer the necessary intelligence based on ultra-low power/high-performance control units.

-

Similarly, advanced control methods for fuel cell-based vehicles (mainly in trucks and buses) that both minimise degradation and maximise efficiency are crucial. For example, predictive control schemes that take into account forecasts on e.g. route, traffic, weather, etc. are necessary. State-of-health monitoring systems (virtual sensors) as well as adequate new sensors to measure the operating conditions within fuel cells without negatively influencing their operation, are required.

-

For both electric battery and fuel cell-based mobility, new safety concepts using (AI-based) IoT diagnostics must ensure the safety of these systems, especially in accident situations.

-

Low environment impact of new technologies in terms of energy consumption at production, deployment, use and end of life treatment.

-

Reduction of sensible materials such as rare earth materials.

-

Recyclability of electronics: the environmental impact needs to be considered (eco-design, circularity…) because it requires an ecosystem approach, which includes the mobility application industry

-

Efficient and fast charging and filling of alternative energy into green vehicles is another critical research topic. Being the glue between Transport & Energy Sector, “Plug and charge” is an essential topic.

-

The conversion of renewable energy into green energy, as electricity stored in vehicles or H2 or alternative fuels, also needs efficient electronics with real-time embedded software with energy management SW communicating to the power grid to minimise the need of new charging/filling infrastructure, which is one of the cost drivers limiting the speedy success of green mobility.

-

Smart Battery: with the batteries in electric vehicles being the most expensive and life-time critical parts, future battery systems will be equipped with more sensing technology, intelligence, and communication systems to monitor their own health and record their lifetime dataset. This enables better usage of the batteries as well as optimised second life concepts.

-

Power electronics (fast-switching elements, wide bandgap materials, low power, etc.).

-

Predictive diagnosis and maintenance (including recovery strategies, fault detection and localisation, surveillance sensors, etc.).

-

Cloud/edge/fog processing approaches.

-

Standards, including communication and interoperability standards, electromagnetic spectrum, and bandwidth management, charging units, car access systems, etc.

-

Proof of robustness and trustworthiness of architectures and quantification of the operational risks.

-

Collaborative and self-organised multi-agent systems, e.g. in logistics applications also covering cooperation between land and air vehicles.

By 2050, 67% of the population is expected to live in urban areas. As cities become bigger and smarter, this trend will lead to new opportunities for tailored and specialised vehicle design specific to urban users, including the needs and operations of commuters, as well as ride-hailing and last-mile delivery. New vehicle concepts and ECS-enabled architectures will lead to flexibility, scalability, and modularity - while featuring safety, security, and reliability - to ensure urban-readiness (appropriate range, compatibility with charging infrastructures, ease of parking and operations, etc) in all kinds of urban and suburban areas, most likely with different implementation levels of infrastructure and smart technologies. Additionally, it is assumed that these vehicles will not have to be designed for high-speed operation and long range and can easily be charged sufficiently fast and comfortably to meet the daily needs of urban and suburban mobility usage scenarios. This aspect may also include sharing concepts, and consideration should also be given to use by the elderly and disabled.

Another important aspect is the need for reliable and efficient wireless communication technology combined with different types of sensing systems to achieve efficient traffic and increase safety as well as reduce fatalities. This further sets requirements on components and systems for wireless communication to achieve ultra-high reliability and resilience as well as to meet challenging performance and latency demands.

The challenge targets the following vehicle categories:

-

Passenger cars (including light four- wheelers, M1/M2 category).

-

Trucks (including power-driven vehicles having at least four wheels used for the carriage of goods (N1), agricultural and forestry tractors, and non-road mobile machinery (T)).

-

Ships.

-

Airplanes.

-

Motor vehicles with less than four wheels (L category).

-

Off-road vehicles (G).

-

All kind of unmanned air vehicles (such as drones).

-

All kind of manned light air vehicles.

-

Special-purpose light vehicles (air, land, water).

Creation of synergies between different transport systems can bring cost advantages (automotive – air – freight)

The developments described above ask for innovative mobility solutions in the years to come, affecting European society:

-

Urban light personal and small freight mobility (including innovative micro-vehicle designs suitable for urban/suburban commuters’ needs, with an option for usage within shared mobility schemes. Such micro-vehicles would also be capable of interfacing with urban collective transport systems (i.e. easy access to buses, trams, and trains for last-mile transfers to achieve full intermodality).

-

Light and flexible multi-passenger vehicles (e.g. collective, or individual, owned or shared up to M1 category) with robust safety measures for passengers and vulnerable road users, and including specific features to facilitate shared use such as autonomous-capable vehicles with automated relocation to charging points or areas with insufficient vehicle density.

-

Long-haul and right-sized vehicles and tailored ECS for commercial uses, such as for long distance, last-/first-mile delivery, construction and maintenance support, which are suitable for urban scenarios.

-

Environment friendly mobile machinery to optimise harvesting (and reduce accidents).

3.1.4.4 Major Challenge 4: Provide tools and methods for validation and certification of safety, security, and comfort of embedded intelligence in mobility

Regain European sovereignty in embedded software for mobility

All of the four mobility megatrends (electrification, autonomy, connectivity, shared mobility) highly rely on leading-edge software. Especially the car industry needs to face this new software-driven value chain. A typical modern vehicle likely has a software architecture composed of five or more domains (body, chassis, ADAS/AD, powertrain, infotainment, …), together comprising hundreds of functional components in the car and in the cloud. Currently, OEMs are constructing a complex software architecture with various software providers ending up in a complex scenario with a broad set of development languages and interfaces/APIs, operating systems, and software structures/elements. Up to now no single software platform (middleware) on the market can meet the requirements of Connected, Cooperative and Automated Mobility (CCAM). The domain-based hardware architecture is rapidly evolving towards a zonal architecture, where the software architecture, implementation and the corresponding development environment needs to be compatible. A middleware layer has to separate the hardware layer from the software layer and allow faster time-to-market to standardised interfaces.

The work on the mobility challenges will help to protect the sovereignty in the digital heart of mobility devices (passenger cars, trucks, …). In the past, Europe had a leadership in the embedded software in all kinds of vehicles. This is endangered by the push of the big global IT companies into the embedded IT systems of the vehicles. Europe has to protect its leadership in creating a next generation of middleware and operating systems prepared for the significantly increased complexity of CO2-neutral automated and assisted vehicles.

Europe envisions fatality-free transportation as well as seamless mobility choices (including multi-modal services) for its citizens, particularly in view of the aging society. Moreover, the transport industry in Europe in general aims to maintain its leading position by offering sustainable solutions for safe and green mobility across all transportation domains – automotive, avionics, aerospace, maritime (over water as well as under water transport) and rail. Europe’s strength lies in its established expertise in developing complex electronic components, cyber-physical systems, and embedded intelligence. However, hurdles related to autonomy, complexity, safety, availability, controllability, economy, and comfort need tackling as automation increases. The overall vision is to achieve always-connected, safe and secure, cooperative and automated transportation systems (passenger transport, cargo and freight movement) using highly reliable and affordable European-made electronic components and systems. These systems will also incorporate new human-machine interaction technologies.

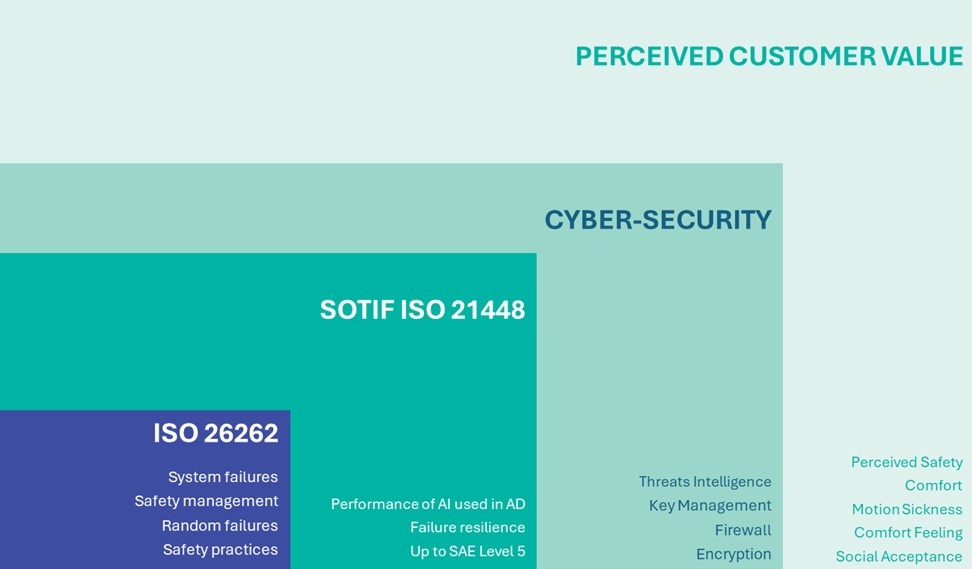

For the road sector, objectives are (a) to reduce the number of road fatalities and accidents caused by human error to zero by 2050, (b) to ensure automated transport introduces no additional road fatalities, and (c) to decrease validation costs down to 50% of development costs from the current 70–80%. Key Digital Technologies are crucial for achieving these goals and supporting the ambitions of the Horizon Europe Partnership on Connected, Cooperative and Automated Mobility (CCAM). Collaborations in and across industrial domains, learning from operational field data, and joint strategic actions are essential. No single entity can singlehandedly manage these significant R&D efforts.

For waterborne transport, as automation progresses ships will become fully connected, globally. Remote vessel monitoring is already possible, allowing for condition-based maintenance. Building on increasing onboard automation, the remote operation of vessels will become possible, eventually moving towards full autonomy for vessels. The wider use of unmanned autonomous vessels (UAVs) – either aerial, underwater or on the surface – will increase the flexibility and energy efficiency of operations. For avionics and aeronautics, automation is paving the way for more efficient flight management, reducing pilot workload, and enhancing predictive maintenance, which collectively promises safer and more efficient air travel. Additionally, Urban Air Mobility (UAM) is revolutionizing cityscapes, with automation enabling flying taxis and drone deliveries, presenting a transformative solution to urban congestion, and offering a new dimension to urban transport. For the rail sector, automation is driving the development of driverless trains, optimizing track usage, enhancing scheduling accuracy, and ensuring safer and more punctual journeys for passengers.

Connected, cooperative and ultimately automated mobility will play a central role in shaping our future lives. ECS will enable different levels of partial, conditional, highly and fully automated transportation, posing new challenges for traffic safety and security in mixed scenarios where vehicles with different automation levels coexist with non-automated vehicles. Reliable and fail-operational approaches for tele-assistance and tele-operation need to be considered as well to remove the safety drivers from the cabin. Both stepwise automation (“conversion design”) and full automation (Society of Automotive Engineers, SAE, level 5: “purpose design”, e.g. a people mover in a structured environment), have been developed to the prototype level and are being deployed in field-operation tests right now. Nonetheless, these solutions need to be further explored and improved towards safe and reliable capabilities in extended operational design domains. Additionally, cross-fertilisation with other industrial domains such as Industry 4.0 and Industry 5.015 and evolving communication technologies (5G/6G) is essential.

As the proportion of electronics and software, considered as a percentage of the total construction cost of a vehicle, increases, so does the demand for the safe, secure, reliable, and unhackable operation of these systems. In addition, privacy protection is paramount for car owners, drivers/operators and passengers as well. This demands robust and fail-operational technologies that deliver intrinsically safe operation and dependable fall-back position from component to subsystem and provides a solution for problems in interaction with the cloud. Also, multi-core-based platforms and sensing devices, combining advanced sensing in harsh conditions, novel micro- and nano-electronics sensors, advanced sensor fusion and innovative in-vehicle network technology are needs. While CCAM promises significant benefits, it also faces numerous challenges to be faced. These challenges are manifold since the include technical, safety & security, legal but also social challenges.

Safety and security for humans are essential. ECS systems as health monitoring, drowsiness monitoring, etc. will focus to increase safety and healthiness of vehicles passengers. Security of the passengers is another important RDI area, as increasing communication with various cloud systems, complex infotainment systems and powerful AD sensors open many intrusion doors.

Key RDI topics:

Technology challenges

-

Complexity of algorithms: Developing robust, reliable algorithms for autonomous driving that can handle a wide range of scenarios and conditions is highly complex. This includes perception, decision-making under uncertainty, and control algorithms in multi-agent and multi-modal settings.

-

Sensor limitations: Sensors like LiDAR, radar, and cameras can be limited by weather conditions, lighting, and other environmental factors. Ensuring reliable sensor performance in all conditions is the key to succeed.

-

Data processing and integration: Autonomous vehicles generate vast amounts of data that need to be processed in real-time. Integrating data from multiple sensors and sources while ensuring low latency is critical.

-

Infrastructure Requirements: CCAM requires significant investment in infrastructure, such as high-definition maps, roadside units (RSUs), and vehicle-to-everything (V2X) communication systems. Implementing and maintaining this infrastructure is costly and complex; prioritization is required along with robust connectivity services.

-

Artificial intelligence (AI): Reduction of the computational complexity of AI algorithms, advancements in energy-aware hardware design, including low-power processors, energy-efficient sensors, and power management techniques, along with edge-cloud collaboration, resource management, and continual learning / adaptability strategies are highly required.

Safety and Security Challenges (refer also to SRIA chapter 2.4 Major challenge 3)

-

Cybersecurity: CCAMs are vulnerable to cyber-attacks, which can have severe safety implications. Ensuring robust cybersecurity measures is essential.

-

Safety assurance: Proving the safety of autonomous systems to the level required for public deployment is difficult. This includes extensive testing, validation, and establishing safety standards.

-

Fail-safe mechanisms: Developing fail-safe mechanisms and redundancy in autonomous systems to handle system failures or unexpected situations is a significant challenge.

Regulatory and legal challenges (refer also to Chapter 2.4, major challenge 4)

-

Regulatory frameworks and liability: Creating consistent regulatory frameworks that can keep pace with rapid technological advancements as well as determining liability and allowing for interoperable and fast deployment across Europe is challenging.

Ethical and social challenges

-

Ethical decision-making: Autonomous vehicles must be programmed to make ethical decisions in situations where harm is unavoidable. Creating consensus on these ethical frameworks is difficult.

-

Public acceptance: Gaining public trust and acceptance of autonomous vehicles is crucial. This involves addressing fears and misconceptions about the safety and reliability of the technology.

-

Impact on employment: The widespread adoption of autonomous vehicles may impact jobs, particularly in sectors like transportation, logistics and digital industry.

Environmental and Economic Challenges

-

Energy consumption: Autonomous vehicles, especially when equipped with multiple sensors and communication systems, can have high energy demands. Balancing energy efficiency with performance is necessary.

-

Economic viability: The high cost of developing, testing, and deploying autonomous vehicles and the necessary infrastructure can be a barrier to widespread adoption. Ensuring economic viability for manufacturers, consumers, and municipalities is challenging.

Interoperability and standardization

-

Interoperability: Ensuring that autonomous vehicles from different manufacturers can communicate and operate seamlessly with each other and with infrastructure is critical. This requires standardization of communication and data exchange protocols and systems.

-

Standards development: Developing and implementing standards for autonomous vehicle performance, safety, and communication is a complex and ongoing process that requires coordination among industry stakeholders, regulators, and standards organizations.

Addressing these challenges requires collaboration among technology developers, policymakers, regulatory bodies, and the public to ensure that CCAM can be safely and effectively integrated into society.

Key elements of ECS for cars that need to be developed are shown in Figure 3.1‑9.

Key focus areas

Based on the above identified challenges, the following research priorities and development & innovations areas have been identified to boost the maturity and deployment of CCAM:

Robust Perception and situational awareness: Reliable perception systems are essential for enabling robots to interpret and navigate complex environments effectively. Dependable and affordable environment perception and localisation sensors, and V2X communication. Attention should be paid to sensor interference, more in particular the robustness of sensors to environmental conditions, to interference by other sensors and to malicious interference.

Integrated sensing and communication systems are necessary to further evolve towards fully automated transport and safeguarding VRU’s (Vulnerable Road Users) in all type of traffic and weather situations (especially also at night or in adverse weather).

Real-time collaborative decision-making under uncertainty is essential for enabling autonomous vehicles to respond quickly to dynamic environments and perform tasks with precision. Research efforts should focus on optimizing non-AI and AI algorithms for low-latency execution on edge devices, leveraging techniques such as model parallelism and hardware acceleration. Edge computing architectures must be designed to minimize processing delays between data acquisition and actuation.

Hardware-software Co-design, digital twinning and continual learning: The synergy between hardware and software components is critical for maximizing the performance and efficiency of CCAM systems. Research should explore co-design methodologies that tailor hardware architectures to the specific computational requirements of AI algorithms used in robotic applications. The ability of robots to adapt and learn from their interactions with the environment is crucial for achieving long-term autonomy and versatility. Advancing from ego-vehicle optimization to multi-agent settings optimization including edge-cloud communication is a logical step forward.

Real-time processing: Centralised service/function-oriented hardware/software architectures, including open APIs, for road vehicles, ships, trains that are supported by the cloud and edge computing via 5/6G along with dependable and reconfigurable hardware and software, including remote access and Over-The-Air (OTA) software upgrades. Hardware and software platforms for control and higher performance in-vehicle networking units for automated mobility and transportation (including support for AI), for example the usage and adaptation of IoT integration platforms, also for automated and connected environmentally friendly vehicles. New developments towards higher performance and efficiency are crucial: These are also required to ensure the reliability and safety of the power electronic components and systems for the drivetrain and charging systems, as well as for steering, breaking/suspension/air condition control in automobiles, trains, ships, and flying equipment.

Advanced AI-based and predictive control methods to create new active safety paradigms for the next generation of automated vehicles, e.g. to operate beyond the boundaries typical for the current generation of stability controllers and chassis control systems, when this is needed to prevent road accidents. This also implies a redefinition of the software architecture to integrate the chassis control and driving automation functions. The current generation of chassis control systems – which will be used in the first generation of automated vehicles – is designed to keep the vehicles within limits that are desirable for human drivers, but further research is required to assess the new active safety options (e.g. race driving techniques to prevent crashes in emergency conditions) enabled by driving automation. Multi-functional cross-domain and preview-based control software implementations, e.g. powertrain and brake-by-wire controllers concurrently managing energy efficiency, active safety, and comfort aspects (e.g. powertrain torque distribution to induce desirable pitch in braking, compensation of the longitudinal acceleration oscillations caused by road irregularities through road preview-based control of the powertrain torque).

(Predictive) health monitoring and lifetime analysis for the perception and control systems (including all required sensors, V2X systems and localisation systems) and AI components of (highly) automated vehicles used in the operational phase.

These research priorities result in completely new hardware and software architectures for the control systems (non-AI, AI-based) due to exploding sensor data volumes, dynamic adaptability, multi-agent requirements as well as new power saving hardware and software components. This requires a decoupling from hardware with drivers and operating system, from the application components, adaptive AI-based routing and control algorithms, multimedia components and many more, and at the same time a co-designed process of interface developments. These demands directly impact the Chips JU strategy on software-defined vehicles (SDV)16. As CCAM methods and technology advances should be application independent per se (of course, capable of being tailored to specific applications), collaborations with the AI and robotics community should be strengthened and implemented, e.g. with the AI Data Robotics Association (ADRA)17 or the US National Robotics initiative18.

3.1.4.5 Major Challenge 5: Achieve real-time data handling for multimodal mobility and related services

The rapid advancement and integration of Cloud-Edge-IoT (CEI) technologies are primarily driven by an increasing demand for digital twins, immersive communication, and secure mobile robotics, alongside the need for low-latency and real-time capabilities at the edge of networks for a multitude of innovation fields. These technologies are crucial in addressing the challenges posed by energy shortages and climate change, as they promote energy and resource efficiency through new hardware and AI-based optimizations. At the same time, they provide advanced intelligence and data-based decision making capabilities deep in the networks of technical systems of systems. These leads to powerful mobility services distributed between cloud and vehicle SW. Off-board SW technologies differ from classical vehicle SW technology and need to be integrated into mobility application architectures. Cloud-native architectures are moving partially also into vehicle SW in these new mobility applications.

As such, these innovations not only meet the technical demands of a modern digital infrastructure but also offer competitive advantages and open new business opportunities within a globally competitive market. Transport and mobility is a major application sector of CEI technologies since it aims at vision of zero emissions, zero accidents and zero hurdles between modes or a sustainable, safe and convenient personal mobility experience or freight service.19 The growing use of CEI systems in transport and mobility presents a major opportunity for European companies to increase their cloud capacities and improve their edge computing technologies. This could help them compete with international rivals over time. However, for now, the dominance of international hyper-scalers in providing cloud services may impact the influence and control of established European players.

Some general potentials and issues of applying CEI in the transport and mobility sector need specific attention:

Opportunities:

-

Data critically determining safety, privacy, and efficiency of transport operations can be effectively processed with low latency and high security on edge platforms close to sensors and actuators.

-

Operations of strategic relevance for transportation, such as planning, modelling, data analysis, software engineering, maintenance, AI computations, and the management of software updates, including the potential resale of data, can be effectively centralized in the cloud.

-

CEI technologies pave the way for innovative services in the transport sector, such as shared transportation platforms and automated vehicles, enhancing system efficiency and user experience.

Challenges:

-

Concerns about data sovereignty and privacy may hinder the deployment of CEI technologies, particularly in the public transport sector, where the mass transfer of data to international servers with limited oversight is faced with scepticism from users.

-

The ongoing debate over data ownership, particularly in the public sector, about whether data should be generated and managed by public authorities or outsourced to private service providers applies to transport operators emphasizing the need for data sovereignty in governmental data management.

-

The transport sector faces a risk of vendor lock-in, with limited alternatives for European IoT companies and users in selecting cloud providers, which could stifle innovation and competition.

-

Cybersecurity is increasingly challenging due to the growing communication channels from the vehicle to the outside world.

As the functional scope of transportation sector is quite divers considering transport modes in passenger and freight transport, the field of IT-solutions and thus conceivable CEI applications is very large. The CEI applications may concern transport networks, vehicles, traffic management, mobility services, data platforms, logistics applications, fleet management, planning applications etc. An efficient Cloud-Edge-IoT (CEI) infrastructure for transport and mobility applications requires multiple innovations across several functional layers, each with specific needs:20

-

Design Layer: This layer must accommodate real-time processing of large data volumes, such as those from traffic management systems. It requires substantial computational power to handle data from diverse road users including cyclists and pedestrians, not just vehicles. Integrating data protection, privacy, and adherence to regulatory and governmental standards is crucial to ensure the system's legitimacy and trustworthiness.

-

Installation Layer: As the number of sensors in traffic management increases, the installation layer must address the challenge of power supply, possibly smart charging utilizing e.g. lamp poles, interacting with the power grid and exploring new energy sources. Efficient connections between new sensors and edge computers need to be established, and the financial implications of installation must be discussed, ensuring robust communication capabilities between different city departments.

-

Operation Layer: The operational functionality must manage dynamic traffic volumes effectively e.g. through traffic lights and controls) or provide efficient and seamless transfer between transportation means (e.g. though integrated ticketing), maintaining high data quality and security even in adverse conditions through the use of AI and appropriate sensors. Data should be real-time, accurate, and secure, yet openly accessible where appropriate. Proper sensor placement and the ability to retrieve data from multiple computers are essential for operational integrity.

-

Value-added Supplements: Innovative features such as two-way communication between automated vehicles and traffic signals, and enhanced capabilities for rapid incident or adverse weather detection, represent value-added layers that leverage CEI technology to improve traffic management and safety. The provision of content for entertainment systems is another way of adding value through CEI.

-

Maintenance Layer: Traffic control equipment typically has a long lifecycle, often misaligned with the faster modernization cycles of other computing equipment. Maintenance practices should consider this discrepancy to ensure consistent performance and easy upkeep.

-

Disposal/Upgrade Layer: Given the long lifespan of traffic control systems, a strategic approach is necessary for integrating and replacing legacy systems. Complete system replacements are rare; therefore, a planned, phased integration or upgrade strategy is crucial to maintain continuity and efficiency in traffic management.

To effectively implement Cloud-Edge-IoT (CEI) technology in transport and mobility applications, specific technological advancements in ECS necessary namely:

-

Enhanced Computing Power at the Edge: To support real-time processing of traffic data, edge devices installed close to traffic sensors and actuators must possess significant computational capabilities. This allows for immediate data processing and response, crucial for e.g. connected and automated driving systems.

-

Advanced Connectivity and Networking: Reliable, high-bandwidth and low-latency communication networks are essential to manage the continuous data exchange between vehicles, traffic management systems, and infrastructure. This includes vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications, which are foundational for automated driving technologies.

-

Smart Data Management Systems: Implementing comprehensive sensor systems requires robust data management to ensure privacy, security, and accuracy. Systems must be designed to handle large volumes of data generated in real-time from multiple sources across the transport network.

-

Scalable and Adaptive Infrastructure: Infrastructure must be capable of scaling effectively to accommodate an increasing number of automated vehicles and complex traffic management tasks. Modular infrastructure design allows for expansions and upgrades as traffic technology evolves.

-

Intelligent Sensor Networks: Deploying smart sensors throughout the transport infrastructure that can reliably function under various environmental conditions is critical. These sensors gather critical data for traffic management and vehicle operation, feeding into edge computing systems for rapid processing.

-

Integration of AI and Machine Learning: AI and machine learning are pivotal in enhancing traffic management services, such as those based on digital twins of road infrastructure. These technologies enable predictive analytics, traffic flow optimization, and incident detection, all processed locally to reduce latency.

-

Interoperability Standards: Standardization across all devices and systems ensures seamless communication and functionality within the interconnected transport environment. This supports the integration of various manufacturers' vehicles and infrastructure components.

-

Robust Cybersecurity Measures: Transport systems involve critical safety and operational data, necessitating stringent security measures to protect against cyber threats. This includes encrypted communications, secure data handling protocols, and regular security audits.

-

Energy-Efficient Design: Given the extensive use of sensors and computing devices in transport applications, energy efficiency becomes crucial. Utilizing renewable energy sources and developing low-power devices can significantly reduce the environmental impact.

-

Maintenance and Upgrade Flexibility: Transport and mobility systems require maintenance protocols that minimize downtime and disruption. Additionally, the system should be designed for easy upgrades to incorporate new technologies and standards without complete overhauls.

Future research and innovation activities on Cloud-Edge-IoT (CEI) technologies in transport could prioritize large-scale pilot projects, particularly integration AI to enhance real-time traffic management and vehicle automation. Key areas include:

-

AI-driven Traffic Management: Developing systems that utilize real-time data from individual road users to dynamically control traffic situations. This involves AI algorithms capable of processing large volumes of data at high speeds to improve traffic flow and safety.

-

AI-supported automated tolling systems: Developing systems for vehicles which automatically pay tolls across all roads in Europe and next to Europe without driver interaction. It requires significant work and alignment in the cloud. Here the automotive industry as well as the road operators across Europe have to cooperate. Regulatory support may speed up this difficult alignment process and the solutions for the development challenges

-

Automated charging systems: Developing systems automated charging and billing. Next steps may include systems, which solve the problem, that low speed charging often results in high parking costs after the completion of the charging for customers, who have no opportunity to charge at home. Systems, which automatically move cars from charging positions to parking positions may offer a solution, alternatively automatic repositioning from charging infrastructure from one parking position to a next parking position after completion of charging could solve the problem. Here the automotive industry as well as the charging provider industry across Europe have to cooperate. Regulatory support may speed up this difficult alignment process and the solutions for the development challenges. Without such systems, the acceptance of electrical vehicles for the large part of the European population without a fixed parking space will be very slow, which may significantly endanger the transition to CO2 free mobility.

-

Automated Parking-fee payment systems: Developing systems for vehicles which automatically pay parking fees across all public parking garages in Europe and next to Europe without driver interaction. It requires significant work and alignment in the infrastructure and the cloud. Here the automotive industry as well as the parking garage operators across Europe have to cooperate. Regulatory support may speed up this difficult alignment process and the solutions for the development challenges

-

Road weather condition info systems: Automated vehicles would benefit from information about wet roads, icy roads, slippery roads. This information can be derived from a wheel speed analysis from other cars, whose results are collected from road operators. They can merge the results with weather data, dedicated infrastructure systems data and weather forecasts as well as AI based predictions. Again, a collaboration between automotive industry and road operators is necessary

-

Bidirectional charging to stabilize the electrical grid: Developing systems for vehicles which can utilize the vehicle batteries to stabilize the grid. It requires significant work and alignment in the cloud. Here the automotive industry as well as electrical energy providing industry across Europe have to cooperate. Regulatory support is essential.

-

Local Level Traffic and Pedestrian Management: Projects that focus on detecting and controlling traffic and pedestrian movements at the local level to facilitate real-time responses and enhance connected and automated driving systems.

-

Many more similar SDV application, which require in-vehicle development combined with development in other industries are possible. Many of these applications will require an App store for vehicle SW purchase-able via OTA.

All these applications are candidates for applications in SDV, which offer a significant increase in comfort for customers as well as an important societal value. They have in common, that different industries have to work aligned together with the automotive industry. The automotive industry cannot solve these problems alone. In most of the applications regulatory support may be required too for speeding up the process. Associations as CCAM and 2Zero are essential in the coordination of the different industry segments.

Common technological building blocks for these applications are:

-

Automotive Edge Platforms: Creating advanced platforms for software-defined vehicles that can process data on the edge. This would support the higher computational needs of automated driving technologies and enable more responsive vehicle behaviour.

-

Strategic and Tactical Decision Support: Projects should cover the development of decision-support tools that use global optimization in the cloud for strategic planning and edge computing for tactical responses, such as managing crossroads during incidents or heavy traffic.

Obviously so, CEI is closely to the other Major Challenge for ECS in transport and mobility.

3.1.4.5 Major Challenge 6: AI enabled engineering tool chain: agile collaborative SDV SW development and SDV as well as ADAS/AD validation

In the automotive industry, the significance of both hardware and software continues to grow as vehicles shift toward autonomy, electrification, connectivity, and service-oriented models. To guide software-defined vehicle development, several key principles emerge:

-

Open Source: Embrace open-source practices, fostering collaboration and transparency. Open-source software allows for community-driven innovation and accelerates development.

-

Code-First Approach: Prioritize software development, recognizing that it drives value creation. A code-first mindset ensures agility and responsiveness to market demands.

-